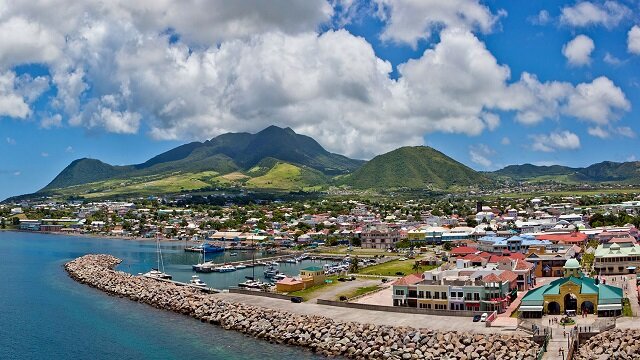

St Kitts and Nevis are two magnificent islands, which in 1967, along with Anguilla, became a free state associated with the United Kingdom. However, the federation of St. Kitts and Nevis achieved complete independence on September 19, 1983. Nevertheless, it inherited the British legal system. The population is approximately 56,500 (2018 est.), of which about 13,500 live on Nevis. The islands exist primarily from the offshore industry and are one of the Caribbean’s best-kept secrets in terms of structuring and holding wealth due to a combination of the following factors:

- They have a British judicial system and predictable law which draws its source and inspiration from the British jurisprudence and the High Court of England, so you not only know what the decision of the domestic court is likely to be, but you have British trained judicial and legal workers to implement it.

Mundo’s country rating is essentially a freedom index whereby our team of specialists rates a combination of freedoms which include freedom from violence and personal attacks, financial freedom from high taxes, business freedom from government interference, and especially from socialism and communism.

Political stability: 10

As Saint Kitts and Nevis is part of the British Commonwealth of Nations, it inherits the political tradition of Great Britain. That is, the Head of State of this jurisdiction is the monarch of the United Kingdom. The head of state elects a Governor-General resident in Saint Kitts and Nevis to represent her in the island’s local affairs.

Saint Kitts and Nevis became a synonym of asset protection. Everyone mildly familiarized with international business and finance knows that the Nevis trust is a privileged asset protection structure. Moreover, during these troubling times of statism and economic instability, more and more people are considering it.

What do the extremely wealthy have that those small middle-class businesspeople don’t have? Basically, tools to protect their assets. The world has told the middle class two lies: 1) That offshore structures are shady and illegal and 2) that only the wealthy can afford them. That’s not true, and Nevis proves it. In this article, we spoke about the Nevis trust, but here we come to show you an even more flexible structure to protect your assets in the offshore Caribbean paradise par excellence, Nevis.

We have reached the most crucial section of this country page, and let us explain why this is so. We have pointed out extensively that two things have become vital for survival during the new world order, and these are (1) second citizenship and (2) asset protection.

Nevis banking laws provide utmost secrecy for Nevis accountholders, making it one of the world’s prized jurisdictions. Furthermore, Nevis is a solid banking destination for those that might not want to look for exclusive banking destinations such as Switzerland, Cayman Islands, or Liechtenstein, but still want first-level privacy and tax optimization.

For wealthy families and individuals, privacy is key. It is not a coincidence that the Rockefeller family has established their properties in such a fine structure of trusts that it is actually impossible, even for governments, to know what they own. We are not saying that everybody needs such a high anonymity level, but we show this as an example of how important privacy is for high and ultra-high net worth individuals.

Saint Kitts and Nevis actually offers this type of privacy through a solid banking system. The country is a CRS member since 2017, but again, so is practically the rest of the world.

Many family offices seek to obtain financial licenses that allow them to establish a brokerage business, an EMI, or even a bank. Establishing your own bank for your family office is as old as the very same concept of a family office because Baron Rothschild himself used it. A bank or at least a financial institution gives you more flexibility and security to protect your assets and is an outstanding source of income.

As usual, Nevis is an excellent option for a financial license. Why? Because it is not as expensive as an A+ jurisdiction (where it is almost impossible to receive one of these licenses) but is a reputable place, has an excellent financial infrastructure and, of course, is much more affordable.

Nevis offers you financial licenses with budget-friendly costs and has regulations oriented towards protecting investors and promoting their businesses:

- Nevis was one of the first Caribbean countries to enact a crypto and fintech sandbox to promote financial innovation within its territory.

Asset protection is key, and you must know it since you are reading this article. Great start. Therefore, you must be aware of how the trust structure has been used to protect and maintain wealth throughout the generations in countries with English common law. Modern offshore trusts are used to accumulate assets, as well as protect them from legal assault. In that sense, St. Kitts and Nevis has become a preferred jurisdiction for the establishment of trusts and funds.

As you may know, our main product is the Forever Free Package, a full family office structure to protect and multiply your intergenerational wealth. A trust is the keystone of a family office, a tool that has been used by the wealthiest families worldwide to safeguard their wealth for generations to come. Why? Because when you set up a trust, your assets stop being legally yours, meaning that no angry creditor or greedy tax authority can lay their hands on it.

With well-chosen real estate assets, you could enjoy predictable cash flow, excellent returns, tax advantages, and diversification. Therefore, we want to introduce you to the options and benefits offered by the real estate sector in St. Kitts and Nevis. This country is highly diversified and offers incredible opportunities. To buy St Kitts and Nevis property, several options are available for foreigners, and they can also obtain citizenship through them. In this section, we have prepared a brief introduction about two real estate options that can show the real beauty and great prospects in this sector: Zenith Nevis, Park Hyatt St. Kitts, Christophe Harbour St. Kitts projects and much more.

This island country attracts people from all corners of the world for its breathtaking landscapes, pleasant Caribbean climate, and friendly environment for raising families and conducting great businesses.

This island country attracts people from all corners of the world for its breathtaking landscapes, pleasant Caribbean climate, and friendly environment for raising families and conducting great businesses.

One may ask what possible connection second citizenship has with the COVID-19, and Mundo Offshore can now officially add another reason why you should acquire second citizenship: yes, pandemics like the coronavirus.

One may ask what possible connection second citizenship has with the COVID-19, and Mundo Offshore can now officially add another reason why you should acquire second citizenship: yes, pandemics like the coronavirus.

Starting with this reason, here are the 5 most important reasons why you should seriously consider applying for second citizenship.

Reason 1: Pandemics

During official pandemics or other states of emergency, Martial Law allows countries to officially remove all human rights protections in what they call a state of emergency. Martial Law or state of emergency legislation can be used to close borders and stop citizens from traveling.

Any international investor wanting to put a substantial amount of money into the jurisdiction of St. Kitts and Nevis needs to be very clear about the legal and institutional landscape of this jurisdiction to be sure of how the local legal system operates.

The latest news and updates from the leading government agencies in St. Kitts and Nevis can be a differential advantage over other entrepreneurs and international investors.

Of course, at Mundo, we are always going to give our distinguished readers all the information they need about the best jurisdictions in the world, but if you want to be personally aware of everything that is going on with the government of Nevis, these are the Government Agencies in St. Kitts and Nevis that you can get information from

.jpg)

Investors from the Middle East Show Growing Demand For St. Kitts and Nevis’ CBI Program

The citizenship by investment program in St. Kitts & Nevis was established in 1984 and today is the longest standing option in this market, according to international sources, this program is recognized to reach the greatest standards in the field.

Among the benefits of citizenship in the Caribbean Island, we can find visa-free access to more than 150 countries, no personal income, gift and inheritance tax life, several family-friendly options, and of course, the benefits of living in a paradisiac territory with the most beautiful beaches in the world.

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...

In Panama, the real estate market is significant because of its convenient costs and the permanent r...

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's i...

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)