Can Canadians Use Panama Real Estate to Optimize Taxation? A Tax Strategy Guide

Overview of the Panama Tax System

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's imperative to highlight the following: avoiding tax is never a good strategy. Tax avoidance is a crime and may lead you to high fines or even jail.

So, it's not possible to avoid taxation, but it is possible, however, to use legal procedures to optimize taxation and reduce the tax burden. With that said, we can proceed with the article.

Territorial Taxation

Panama's main advantage when it comes to tax is its territorial regime. What is the advantage of territorial taxation? Those who permanently live and have legal tax residency in Panama are not subject to tax on income derived abroad.

Therefore, if affairs are arranged properly, one can be legally free of tax on many of one’s assets. It's important to keep in mind that all income received and derived in Panama will be subject to tax. Another important point is that being free of tax in one country doesn’t necessarily exempt you from tax in other jurisdictions.

Who Qualifies as a Tax Resident in Panama?

Panama works under the 183 rule, which, practically speaking, means that anyone spending more than six months a year qualifies as a tax resident. Here arises a very important moment: this makes you automatically a taxpayer in the country, but it doesn't recognize you as a taxpayer before other authorities.

If you have businesses, royalties, or real estate in other countries, you will have to be accountable before those authorities and prove that you are a tax resident in the isthmus. This is done through a specific certificate.

Who Needs to File a Tax Return in Panama?

Anyone living in the country of the canal for more than six months a year becomes taxable, and they have to file a tax return even if they don't have anything to declare. If your tax rate is 0, you still must file a return to be fully compliant.

The following individuals enjoy an exemption from filing a tax return:

- A worker under a salary and whose employer has had the whole tax rate deducted

- Retirees who receive retirement income from Social Security and don't have any other job or taxable income/activity

- Individuals or companies that receive income from bank interests

- Those who carry out independent activities receiving taxable income of up to 1000 balboas in a fiscal year, and only if the gross income doesn't exceed $3000 a year

- Individuals who work in agricultural activities and have gross incomes lower than 100,000 balboas a year

* Disclaimer: Mundo doesn't provide tax advice; hence, this article must not be considered as a formal tax consultation. The information stated above has been obtained from official websites; however, it may be outdated at the time of reading. For tax matters, always consult with certified professionals in all jurisdictions involved.

Territorial taxation: What does it mean?

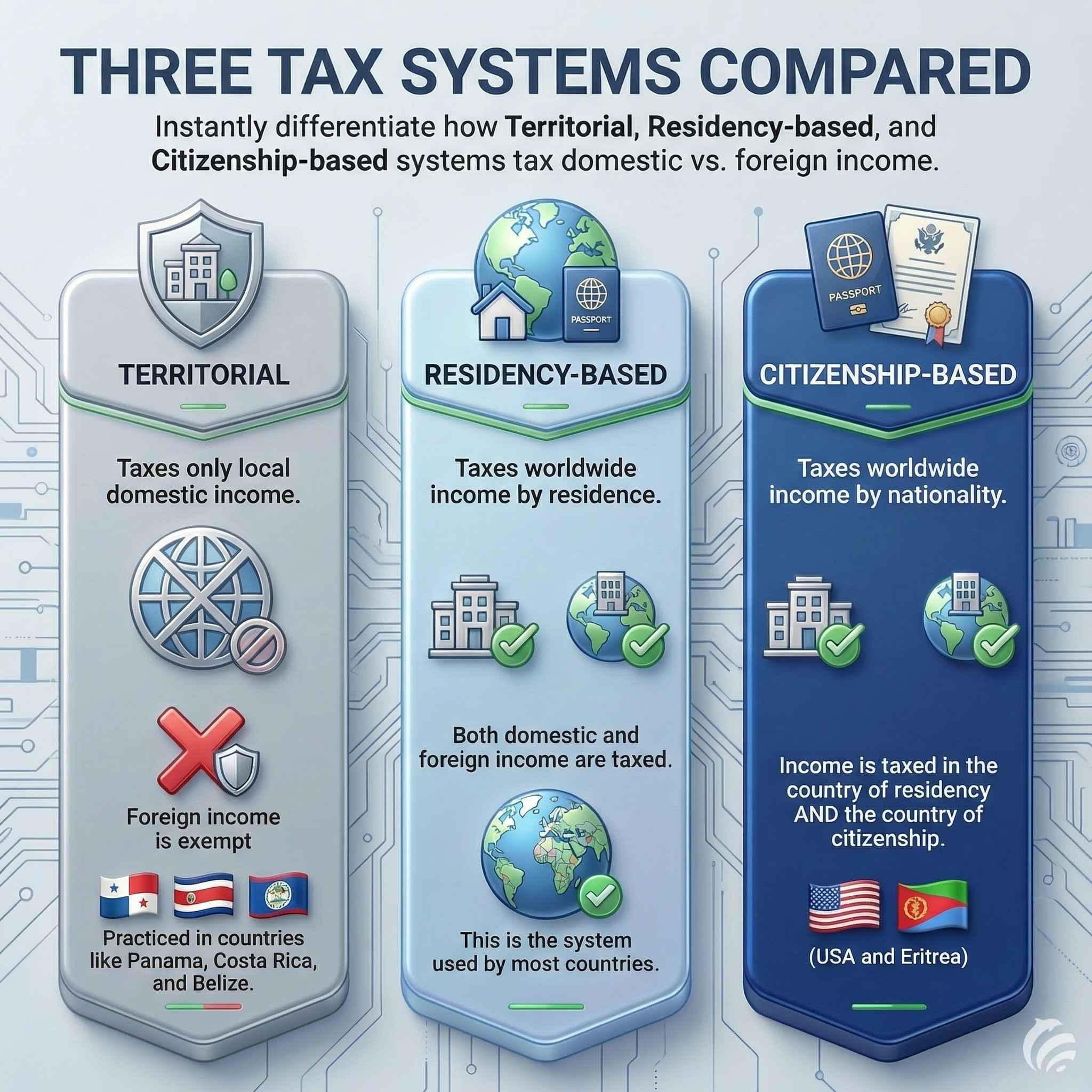

To understand territorial taxation, we have prepared the following comparison between the most common tax systems: territorial, residency-based, and citizenship-based.

Panama’s Tax Year and Filing Deadlines

As stipulated on the DGI’s website (Direccion General de Ingresos), individuals must file their taxes before March 15 and companies before March 31st each year. As for the tax year, it starts on the first of January and ends on the 31 of December, with the possibility of asking for a special year according to Article 713.

Income Taxes in Panama

People who live in the country and are considered taxpayers are taxed only if their gross income surpasses $11,000 a year. There might be different cases, for example, if a person hasn't had any activities throughout the year, they still have to present tax filings if the activities require so.

Individual Income Tax Rates

Income | Tax rate |

Income below 11,000 USD a year | 0% |

Income from 11,000 USD to 50,000 USD a year | 15% on the surplus |

Income over 50,000 USD a year | 5,850 USD on the first 50,000 and 25% on the surplus |

Capital Gains Tax

The standard capital gain tax is 10%, yet, this may vary according to the type of property and the circumstances.

Social Security Contributions

Social security is paid partly by the employee and partly by the employer. Thus, the employee covers 9.75%, while the employer pays 12.25% on the gross income. Mandatory payments include educational insurance: 1.50% (paid by the employer) and 1.25% (paid by the employee).

In March 2025, there were amendments to the social security legislation stipulating that the fees will increase on the side of the employer. The employee will remain paying the same 9.75%. This increase will be applied gradually, and its main purpose is to ensure the sustainability of the social security and pension systems.

Corporate and Business Taxes in Panama

Corporate Tax

Corporate tax is estimated according to the company's activities. If the entity is dedicated to generating and distributing electricity, telecommunication services, selling insurance, producing concrete, operating gambling games, and banking, it will pay taxes based on the incorporation date: incorporated since Jan 1, 2010, pay 30%; incorporated since Jan 1, 2012 pay 27.5%, and incorporated since January 1, 2014, pay 25%.

More information about Panama residency

Value-Added Tax (VAT)

The value-added tax constitutes a 7%, except for products and activities related to school supplies, medicine, basic food, and agricultural products.

Tax Incentives for Investors

We encourage those who want to start a business to find out what benefits are in place at that specific moment, as conditions vary constantly. Panama is famous for its incentives in the tourist sector and for its free zones and special economic zones. Thus, certain activities enjoy an exemption from taxes, and companies are encouraged in different ways to operate in the country.

US Tax Obligations for Americans in Panama

Do You Have to Pay US Taxes if You Live in Panama?

The US has stipulated a worldwide income tax system based on citizenship, not residency (please refer to the graph above). This means that any American with a passport or a green card will have to pay tax in the US for their worldwide income, regardless of where they live. In short, the answer is yes: U.S. citizens will have to pay tax in the United States even if they live elsewhere.

Foreign Earned Income Exclusion

There are certain considerations, like a status called “Foreign Earned Income Exclusion”, which reduces the taxable income, with the maximum exclusion being 132,900 per person in 2026. In this application, the taxpayer can include house expenses exceeding 16% over the maximum. Nevertheless, this has limits and must be considered on a case-by-case basis. Please consult with a US tax expert specialized in foreign income.

Foreign Tax Credit

The expat might be eligible for a tax credit if he/she has paid tax in other jurisdictions.

Reporting Panamanian Bank Accounts and Assets to the US

Although the US is not subscribed to the Common Reporting Standard, it has regulations such as FATCA. According to FATCA, U.S. citizens having accounts abroad must report these accounts and assets to the IRS. Interestingly, this is not related only to residency as the person can live in the US and have accounts abroad.

Filing Taxes with a Panamanian Tax ID Number

Foreigners who are living more than 183 days a year in the territory (whether consecutively or alternatively) are considered taxpayers. Consequently, they will have to obtain a tax ID number for foreigners. This is called “RUC NT” according to the local legislation.

Such a rule applies whether they are independent workers, foreign employees, service providers, or obtain their income through buying stocks or selling real estate.

Obtaining this RUC is relatively simple by submitting a copy of the passport and a statement of the migratory status issued by the Ministry of Immigration and National Security. Also, documentation that proves the existence of the activity and shows the income or dividends must be submitted.

Permanent Residency Options for US Citizens in Panama

Now, to reach this point, a person has to live in the country with a legal permit, which can be achieved through various paths.

Pensionado Program

This alternative was geared for retirees, especially Americans and Canadians, whose retirement incomes are usually too low in their original countries and relatively high in the Republic of Panama.

Such a smart move targets people from any nationality, clearly benefiting those from high-cost regions.

The minimum requirement is having a lifetime pension of at least $1000 a month or $750 plus the purchase of a property worth at least $100,000.

Besides, this visa comes with extra perks:

- Duty-free import of one car

- Duty-free import of personal items up to $10,000

- 50% off entertainment activities like concerts, movies, or sports events

- 50% off hotel stays from Monday through Thursday

- 30% off train, boat, and bus fares for traveling

- 30% off hotel stays from Friday through Sunday

- 25% off airline tickets

- 25% off at restaurants

- 25% off on utility bills

- 15% of hospital bills (unless they have insurance)

- 15% off dental and eye exams

- 10% off prescription medicines

- 1% less on mortgages for properties used as personal residences

Person of Means (POM) Visa

There's an economic solvency visa allowing you to obtain a 2-year permit by making a significant contribution of $300,000 on a fixed term deposit, $300,000 in real estate, or a combination of both.

Immediate Permanent Residence Permit: Qualified Investor

The above-mentioned program has been overshadowed since the Qualified Investor was established in 2021. This alternative offers the same $300,000 real estate investment, but with permanent residency, with the other options escalating significantly to $500,000 ( stock market) and $750,000 (fixed-term deposit).

From Mundo’s point of view, this is the best program as it provides a straight path with simple eligibility requirements and immediate permanent residency in a few months.

Reforestation visa

There is another investment program called “Reforestation Visa”. It invites applicants to contribute to the agricultural sector through an investment in teak land and teak plantations. In this case, they can choose between a 2-year permit or a permanent residency with different thresholds.

Mundo’s visa recommendations

We’ve prepared three hypothetical cases in which different programs can be recommended.

A person with a lifetime pension

If you have a lifetime pension of at least $1000, regardless of your age (it can be from Army Service, a deceased spouse, or disabilities), there is no doubt: Pensionado visa is the cheapest, safest, and most convenient option, especially for Canadians and Americans.

A person who doesn’t want to live in Panama

If you're not planning to live in the country, then probably a Reforestation Visa for $100,000 is the way to go. It constitutes the cheapest investment pathway, offering you long-term profits and allowing you to maintain residency by visiting for a few days every couple of years. During one of these visits, you can renew your permit and extend it for another 2 years or permanently.

A person who wants to live in Panama

If you want to live in the country of the canal, then there's no better option than Qualified Investor because, with a 300,000 dollar investment, you obtain permanent residency and an apartment where to live.

These cases consider particular needs, but in real situations, interests are usually more complex. This is why, for Mundo, the Qualified Investor visa is the ultimate alternative because it fits all cases and brings flexibility to the table.

Further Reading and Resources

Helpful Resources for Expats

The best resource for expats always consists of going straight to the source. This is why we recommend visiting the DGI’s official website. The DGI (Income General Direction) is the government entity that organizes taxation and tax collection in the Republic of Panama.

One last recommendation is: consult with a specialist. In financial, migration, and investment matters, you should always consult with certified professionals, and even more so when it comes to tax, because this is a complex and delicate subject.

Conclusion

Unfortunately, at Mundo, we don’t provide tax advice, but we can help you obtain residency in the isthmus so that you and your tax advisor can design the optimal strategy for your plan and start planning accordingly.

Panama is one of the best countries when it comes to migration because it has several visa programs, and it is widely known for having a tax-friendly system with low rates, benefits, and territorial taxation being its main strengths. Contact the Mundo team and start your path to residency now.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

From all the structures dedicated to protecting one's assets, the trust has been consistently the fa...

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...

In Panama, the real estate market is significant because of its convenient costs and the permanent r...