Malta, the Most Prestigious CBI Program

.jpg.WebP)

Historically, the citizenship by investment programs were limited to a

few Pacific and Caribbean islands that could offer little beyond a second reliable

passport and a legal escape for passport-holders.

That’s pretty good benefits, you may think, and you’d be correct. However, in 2014, the game changed: Malta became the first EU country to offer an extensive CBI program. That means it was the first country to provide additional benefits in an attractive investment environment for those willing to apply for the program.

Malta’s CBI program was an

overhaul in the system. Similar programs followed it in Cyprus, another EU

country, and Montenegro, a prospective EU member.

However, Malta remains the

most prestigious program. Firstly, because it is an EU country, Montenegro is

yet to be a member of the EU. Even as the plans seem to be running well, the

entry was moved from 2022 to 2025. You may say: hey, but Cyprus is an EU member

too! Yes, but its program costs more than double than Malta’s CBI, and Malta

offers similar tax benefits for those willing to apply in the residency program.

And we have good news: In

Mundo, we can offer you the best experts that will help you to obtain a Malta Passport

or residence for you and your family. We work with Discus Holdings, they have

more than 20 years of experience in the area and incredible success rates in

obtaining passport and residence in Malta for their clients.

Before discussing the

specific benefits and requirements of the program, let’s talk a bit about the history

and the island. Malta is one of the most stable democracies and economies in

the world. When Europe faced the debt crisis of 2010 and countries were on the

brink of collapse, Malta and Germany were the only economies that kept growing.

Malta has been an EU

member since 2004 and has an amazingly stable bipartisan political system,

where both parties converge in the importance of the free market and in being a

country attractive for FDI. Malta is an archipelago right in the middle of the

Mediterranean Sea, which has historically made the country a trade hub between

Southern Europe, the Middle East, and North Africa. The country is also a top

Mediterranean tourism destination thanks to its warm climate, heavenly beaches,

beautiful architectonical sites, and over 300 days of sunshine per year.

Likewise, the country

enjoys a fantastic life quality, even for European standards. It has an almost

non-existent crime rate, and both amazing healthcare and educational system.

The country has two

programs for investors: the Global Residence Program and the Individual Investor

Program. The first grants residence, and the second grants citizenship. Both

programs seek to attract FDI to the island and supporting social projects in

the country.

Even better: we work with

one of the top service providers to help high net worth individuals to apply to the

RBI and CBI programs to ensure they can protect their legacy.

Let’s discus some of the benefits.

Why is Malta the ideal option for foreign investors?

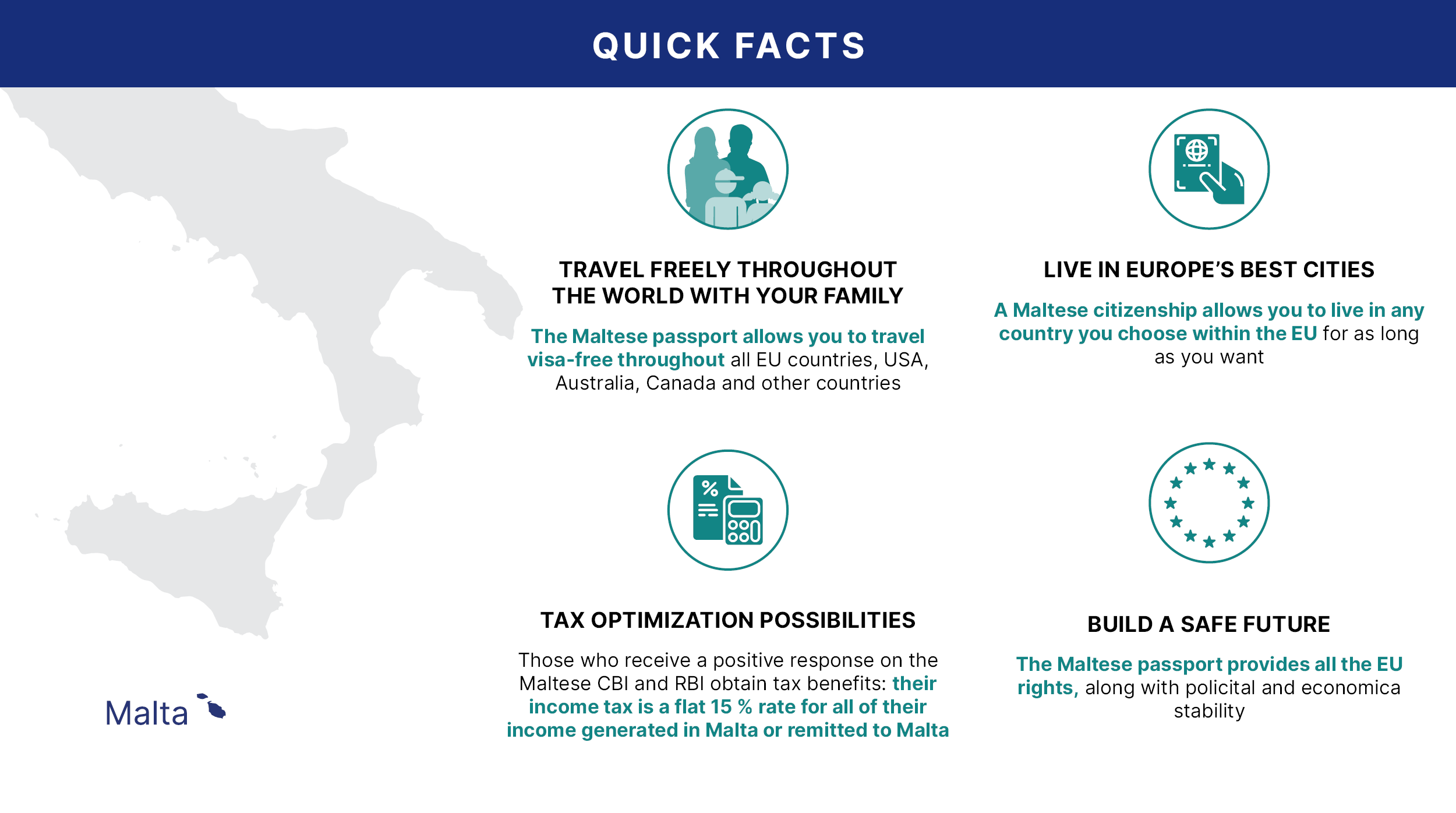

1)

The 7th-best passport in the world,

with full access to the EU and the US

Yes, just as you read. A

Maltese passport gives you visa-free access to 182 countries, which is

significantly higher than the Russian, Chinese, all Latin American passports,

and even most European passports. It’s also the best passport among all

countries with CBI programs. It gives you visa-free access to the USA, Canada,

Japan, the UK, and the European Union.

Moreover, it allows you to

live, work, travel, study, and invest across the European Union and Switzerland,

meaning this passport opens terrific financial opportunities for you and your

family.

This program is definitely

a great choice for wealthy

families and businesspeople. The political and economic turmoil in the world sems to be

never ending which is exactly why it is highly advisable to obtain dual

citizenship.

With the recent crisis of the coronavirus pandemic, you never know when

a country suddenly will decide to close its borders. Holding a second passport

may very well save you from these unfortunate situations.

If you are lucky and never have to go through this, a second passport, especially one from the EU, can help you improve your chances of growth and expand your business to new markets and business possibilities.

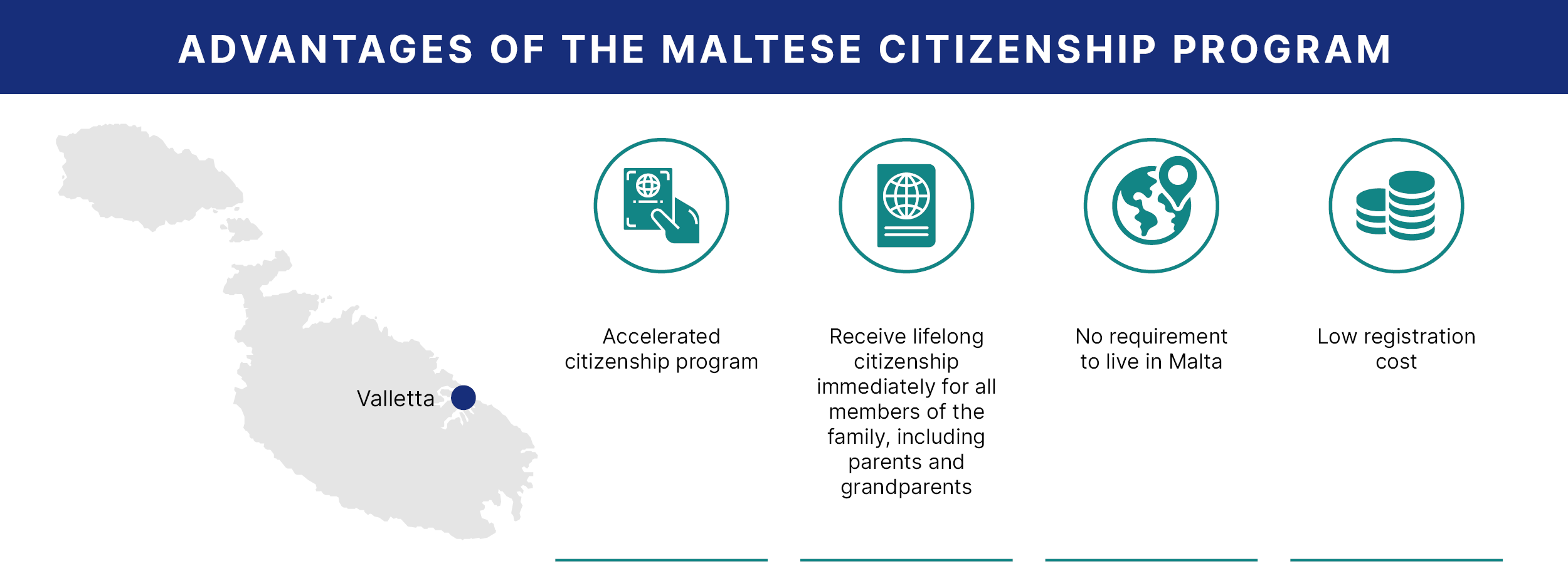

2)

Extensive program

Not only the main applicant can receive the residency/citizenship, but also his or her spouse, children under 18, children over 18 without age restrictions in the residency or up to 26 years old in the citizenship program, if they are financially dependent on the applicant and not married. Even parents and grandparents of the main applicant or the spouse’s, if they live with the main applicant and are financially dependent on him, can receive the residency or citizenship. That means that, across the European CBIs, the Maltese program is the one that allows the largest number of benefited individuals.

3)

Investment opportunities:

Malta is the fastest-growing economy in the EU. Its economy is profoundly diversified, as it produces microchips, provides extensive financial services and was the first country in the world to regulate blockchain-related services. Likewise, the country has had a fiscal surplus in the last two years and has one of the lowest unemployment rates in the EU. It is considered the 42nd freest economy in the world by the Index of Economic Freedom, with particularly high scores in trade freedom and fiscal health.

4)

Tax optimization:

Malta has no wealth taxes,

and its tax base is domicile, not citizenship. That means that those holding a Malta Passport are not automatically tax residents, they are

only taxed on remittances, and there’s no mandatory asset reporting. Likewise,

non-resident citizens are only taxable on their Maltese-sourced income and have

the freedom to reside in any other jurisdiction that allows them to optimize

their taxes.

Furthermore, Malta has more than 70 double taxation treaties, which gives investors plenty of opportunities to optimize and plan their taxes. Likewise, the residency program offers a unique flat 15 % income tax rate for those who receive a positive response.

5)

Full EU support and harmonization

The EU supported the

program from its beginning as Malta guaranteed strong background checks and due

diligence. This attracted plenty of investors that value transparency. Malta

boasts one of the most stable and widely supported CBI programs, as it has been linked with the lesser amount of scandals.

If you’re interested in knowing all our services in Malta, you can check our Country Focus page.

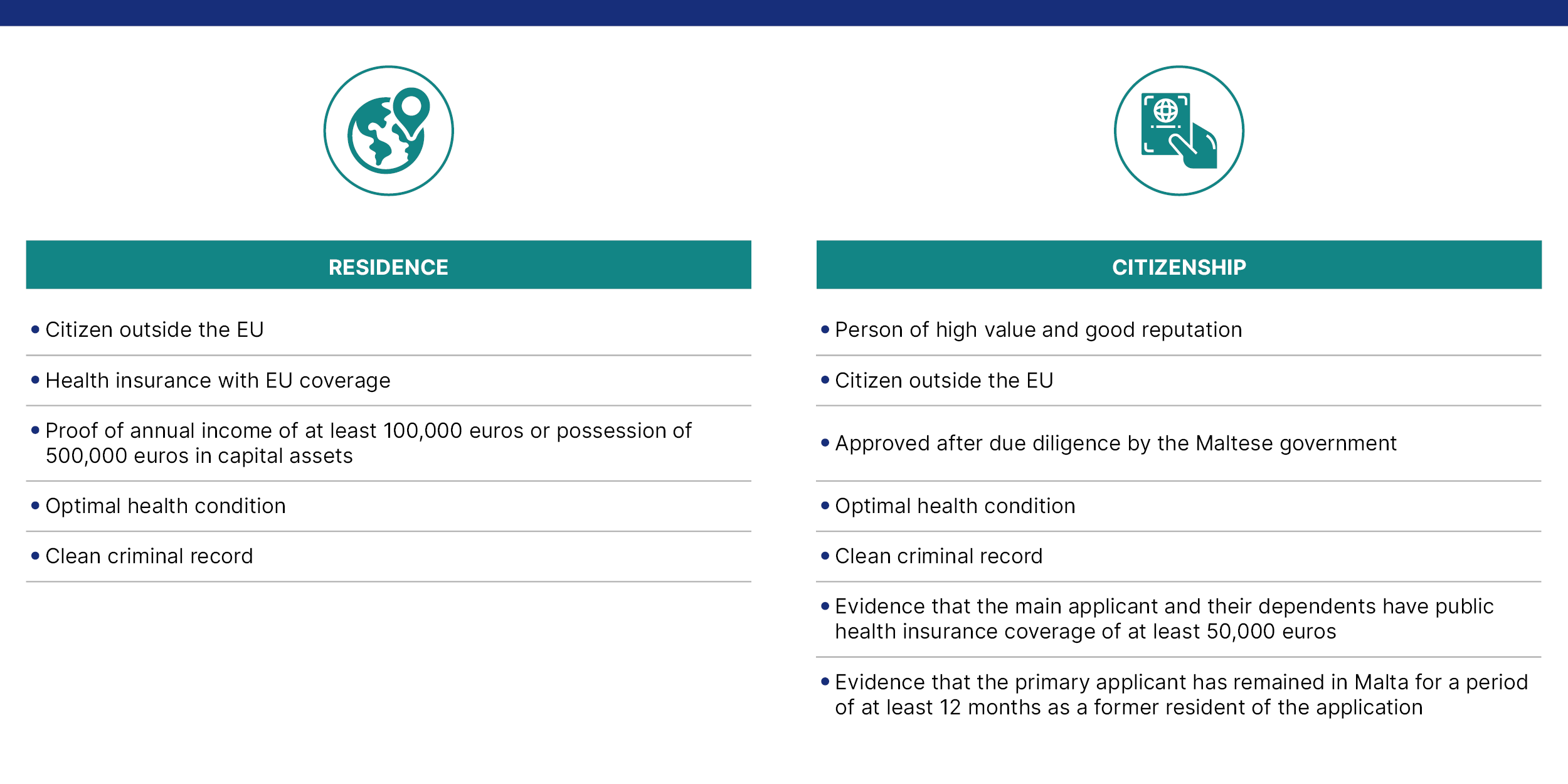

Residence and citizenship

After walking you through

the main benefits of the citizenship and residency programs, let’s start

talking about the specifics. Both programs have similar eligibility criteria

that must be considered before the application:

|

Residence |

Citizenship |

|

Non-EU citizen |

High net worth

individual of good reputation |

|

Health insurance with EU

coverage |

Non-EU citizen |

|

Proof of at least €100k

annual income or €500k capital assets |

Approved by the Maltese

government due diligence |

|

Good medical condition |

Good medical condition |

|

Clean criminal record |

Clean criminal record |

|

|

Proof that the applicant

and dependents are covered by a global health insurance policy of at least

€50k |

|

|

Proof that the applicant

has been a Malta resident for at least 12 months before the application |

Now, we can discuss the

financial requirements of both programs:

The residence

program has way smaller financial requirements:

- Purchase €250k worth of government bonds on the

Malta exchange

- Make a €30k contribution to the National

Development Social Fund (NDSF)

- Rent a property for at least €10k per year or

purchase a property of at least €270k

- You must include an affidavit concerning your

wealth

- The property and investments must be held for

at least five years

- Total minimum investment: €330k with rented

property, €550k with purchased property

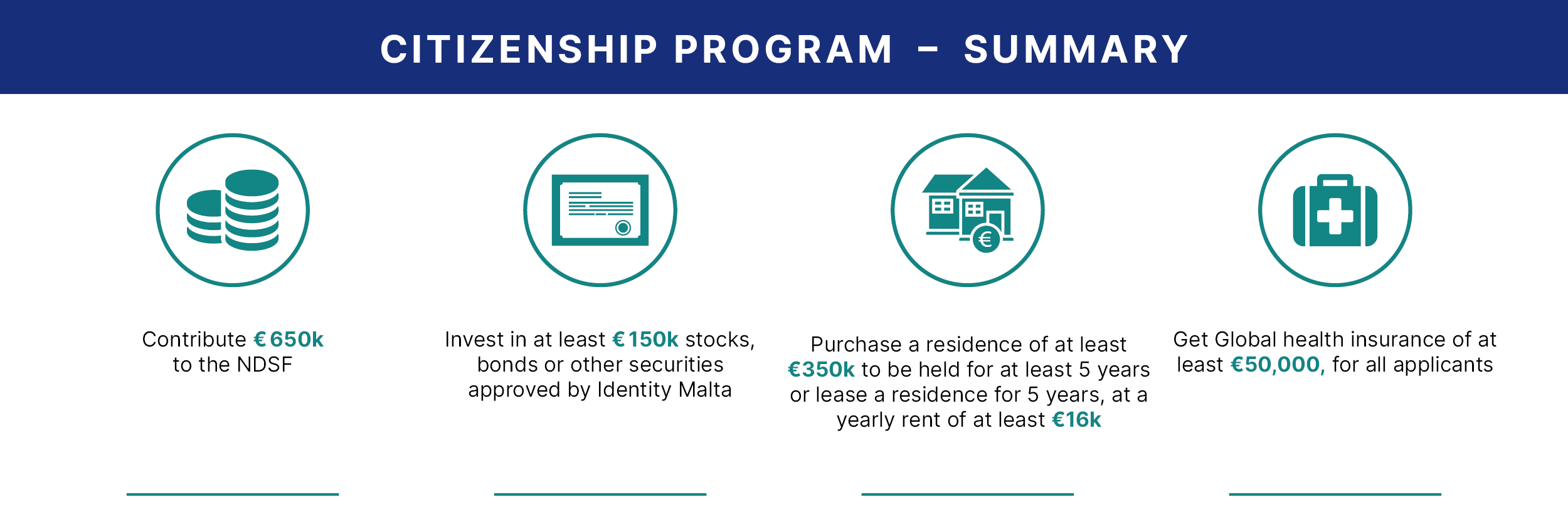

The citizenship

program, logically, has higher financial requirements:

- You need to make a contribution of €650k to

the NDSF

- It is necessary to invest in at least €150k

stocks, bonds or other securities approved by Identity Malta

- The applicant is required to purchase a

residence of at least €350k to be held for at least 5 years, or else lease

a residence for 5 years, at a yearly rent of at least €16k

- The main applicant and all the dependents are

required to get global health insurance of at least €50,000.

- €25k must be added to the NDSF contribution per

dependent minor, and €50k per adult dependent

- Total minimum investment: €1150k with purchased

property, €880k with rented property

You may see that even if the differences are significant, they are somewhat lower than in other citizenship and residency by investment programs. For example, the residency program in Cyprus only requires a €300k investment, while the citizenship program requires a €2m investment.

Why are the programs so different in Malta?

Because they have two different targets. The residency

program points at high-net-worth individuals looking to optimize their taxes in

Malta, as it offers a 15 % flat income tax rate for them, if their income

remitted to Malta is of at least €25k per year, and can also benefit those

individuals from countries that don’t allow double citizenship. In fact, RBI

beneficiaries are required to live in Malta for at least 90 days per year.

The citizenship program, on the other hand, targets high-net-worth individuals who want a robust second passport without necessarily settling domicile or tax residency in that country.

Procedure

Lastly, let’s walk you

through the application process, step by step.

Let’s start with the residence

program. It has five main steps:

1) Preparing and submitting your application: In

this step, our experts will provide an initial back-ground check to see if the

potential applicant is eligible and gather all the necessary documents for the

application. It also includes the payment of the legal fees and filling the

application to start the process formally.

2) Due diligence: The government will start a

background check of the main applicant, his or her spouse, and dependents. It

includes a payment to the security services to start the due diligence.

3) Decision on the application: In this step, the

Maltese authorities will decide over the application. Only after this point,

the main applicant will make the €30k contribution to the Maltese government,

purchase the bonds, and rent/purchase the property.

4) Biometric data and application for the

residency card: The applicant must travel to Malta to submit his biometric data.

5) Obtaining the residency card: The process finishes when the government issues a residency card that is valid for five years, and the applicant can redeem and receive payback for his investments in five years.

You must consider the following fees:

- Legal fees: €30k (they cover the whole family)

- Due diligence fees: €5.5k

Now, regarding the citizenship program, the process is a little more intricate, and in a best-case scenario, it takes 12 months because the applicant must prove he’s resided in Malta for the last 365 days. Nonetheless, the law doesn’t make entirely clear how much time the applicant must effectively spend in Malta. The overall, in some cases, has taken up to 24 months.

Here are the steps:

1)

Our experts conduct initial due diligence to

guarantee the applicant is eligible and has gathered all the necessary

documents, and only afterward will charge their professional assistance fees.

2)

The applicant must fill the application forms and

gather all the required documentation asked by our experts. Here, Identity

Malta conducts the due diligence over the main applicant and his family.

3)

Our experts send the application to Identity

Malta along with the due diligence fees.

4)

Identity Malta provides a response. If it’s favorable, it will

issue a Letter of Approval in Principle to our experts. In some cases, a

Request for Interview may be issued. Identity Malta has the responsibility to

do so in 120 days after the application was received.

5)

When the Letter of Approval in Principle

arrives, the client has 25 days to pay the non-refundable contribution to the

Maltese government.

6) Within four months of the arrival of the Letter

of Approval in Principle, the client must prove to Identity Malta he has

completed the real estate purchase or lease and the acquisition of securities.

7) After doing this, the applicant and his family

must travel to Malta to take the Oath of Allegiance and provide the biometric

data.

8) Afterward, the applicant and all his applicant

dependents will receive their naturalization card and can fill a simple

passport application to obtain it.

You must consider the

following fees:

·

Refundable fees:

- Passport fees (per person): €500

- Bank charges (per application): €200

·

Non-refundable fees:

- Due diligence:

§

Main applicant: €7.5k

§

Spouse: €5k

§

Underage dependent child: €3k

§

Adult dependent child: €5k

§

Adult dependent: €5k

- Upfront contribution to the NDSF: €10k of the total

€650k

In today’s world, having an additional passport/residency is almost a must for high-net-worth individuals.

Malta’s program provides a swift path in both cases, with incredible tax optimization opportunities, secure investments, and strong due diligence that gives you a pathway across the entire European Union. It has the best elements of all other CBI and RBI programs without most of their flaws. That’s why it is the most prestigious program in the whole world.

Who we are

In Mundo,

we want to help you protect your legacy, your investments, and your family.

Since 1994 we’ve been helping high net worth individuals obtain second

passports to protect their investments, their families, and do business with

more freedom.

In these

25 years, we’ve built an unparalleled network of experts to provide first-level

services with an unmatched degree of expertise for our clients. That’s why we

work with Discus Holdings, which is, by far, the best RBI and CBI services

provider in Cyprus, with presence in dozens of countries.

Our

friends at Discus Holdings have more than 25 years of experience in second

passsports and residencies. This excellent team offers complete transparecy,

meaning you won’t have to face unpleasent surprises like hidden fees that you

didn’t expect. For Mundo and

for all our experts, trust is the most important thing and is the

basement on which we build every relationship.

Our experts will also offer support during the process and after the residency or citizenship has been approved. Discus Holdings and Mundo also provide valuable tax and financial advice so that the applicant can take care of his business and assets during the process of acquiring citizenship.

FAQ – INTERVIEW WITH LASZLO KISS, DISCUS HOLDINGS’ MANAGING DIRECTOR

The Malta CBI and RBI

programs are probably the most prestigious. Why have they been so successful?

Answer: In 2020, only two EU Member States have real citizenship by investment programs. Both Malta and Cyprus are flourishing countries with mild weather, welcoming people, and low taxes. Moreover, the Maltese passport is the most useful travel document among all travel documents of the jurisdictions with CIP schemes.

What advantages can the program offer for investors?

Answer: investors can enjoy the incomparable advantages of Malta. They become citizens of the European Union, can travel, live, and work in any other European countries in the Union and the Schengen zone. Don't forget the citizens' children may also study in other states. Also, it's vital to notice that Malta's low-tax regime differs from the other rigid and high-tax laws of most EU Member States. Malta has a long tradition of productive, profitable commerce and banking.

The Maltese financial center is prepared to accept foreign business, there are no cultural barriers, and the financial institutes are flexible. Nowadays, health care became a crucially important question. The blue EU healthcare card allows the holders to receive treatment in any other Member State for free. Maltese citizens, who are living in another country do not have to pay tax on their foreign-sourced income.

Why choose Malta, and not

Cyprus, who is an EU member, too, or one of the Caribbean and Pacific Islands

that offer a CBI program?

Answer: Malta has unique

advantages. First of all, in the EU, only Malta and Ireland use English as an

official language. Don't forget that Malta uses territorial taxation, and

foreign-sourced income is tax-exempt while Cyprus has a worldwide tax system.

Regarding the comparison with the Caribbean programs, the primary benefit of those programs is the Schengen visa exemption. Still, a Caribbean passport does not allow you to live or work in the European Union. The passport of Malta offers you another level of freedom to travel.

The Maltese passport will enable you to enter 169 countries without a visa or by picking up one upon arrival, and it is the fifth strongest travel document of the world. Even the strongest Caribbean passport (of Saint Kitts and Nevis) allows you to enter only 142 countries and holds the 19th position in the international comparison of the passports' strength.

Are the programs seeing

many backlogs? What is the average time it takes to get the CBI and RBI?

Answer: As official agents of the program, it is our responsibility to submit complete documentation. There can be seasonal backlog during the RBI scheme, but if there are no missing documents, we can plan the time frame of the successful processes, according to the law. Regarding the residency by investment program, the due diligence process takes three months. Meanwhile, to obtain the Maltese passport through the citizenship scheme takes one year.

What are the main

differences between both programs? Do they provide the same potential tax

benefits?

Answer: Naturally, the legal status of a resident and a citizen is different. In Malta, the non-domiciled residents enjoy tax exemption on their not remitted foreign-sourced income. Meanwhile, the citizens of Malta can live where they want and can become tax residents in other countries so that they can decide their tax requirements.

Apart from the financial

requirements, do the programs have different requirements regarding the

eligibility criteria?

Answer: No, the applicants must meet the same conditions, the "Fit and Proper" due diligence check of Malta is strict and serves as a role model internationally for the other investor's immigration schemes.

Does the RBI program have

any particular requirements over the minimum annual income? How much has to be

added per dependent?

Answer:

In the case of the Malta

Residence & Visa Program, the applicant must prove an annual income of not

less than €100,000 arising outside Malta or must have a capital of minimum

€500,000. Meanwhile, the eligibility criteria for the Individual Investor

Programme is that all applicants and each dependent must have a global health

insurance coverage of at least €50,000 and must provide evidence that they can

maintain it for an indefinite period.

How many dependents are

allowed by both programs?

Answer:

Under the Malta IIP:

·

a child, including an adopted child, of the

main applicant, or of the spouse of the main applicant, who is less than 18

years of age;

·

a child of the main applicant, or of the spouse

of the main applicant, who is between 18 and 26 years of age, who is not

married, and who proves that he/she is wholly maintained or supported by the

main applicant;

·

a parent or grandparent of the main applicant,

or of the spouse of the principal applicant, who is over 55 years of age, and

proves that he/she is wholly maintained or supported by the main applicant, and

forms part of the household of the main applicant;

·

a child of the main applicant, or of the spouse

of the principal applicant, who is at least 18 years of age, is physically or

mentally challenged, and who is living with and is fully supported by the

primary applicant.

Meanwhile, under the MVRP

Program, the following dependents of the primary applicant may participate:

·

The spouse of the principal applicant in a

monogamous marriage or in another relationship having a similar status to

marriage, unless the Minister authorizes otherwise on a case by case basis.

·

A child, including an adopted child, of the

principal applicant or of his spouse who at the time of application, is less

than eighteen years of age.

·

A child, including an adopted child, of the

principal applicant or of his or her spouse, who at the time of application is

not yet born or not yet adopted by the principal applicant or by his spouse,

and is born or becomes so adopted after the appointed day.

·

A child, including an adopted child, of the

principal applicant or of his spouse, who at the time of application is adult

(over eighteen years of age), not married, and proves that at the time of

application he or she is not economically active and is principally dependent

on the main applicant.

·

A parent or grandparent is eligible, who proves

that at the time of application, that he or she is not economically active and

is principally dependent on the principal applicant.

· An adult child of the primary applicant or the spouse of the principal applicant who has been certified by a medical professional/authority as having a disability.

What are the financial

requirements for the CBI program?

Answer:

The primary applicant has

the following financial requirements during the naturalization process under

the Malta IIP:

1.

Donate €650,000 to the NDSF (National

Development and Social Fund)

2.

Invest in stocks, bonds or other special

purpose vehicles qualified by Identity Malta, for at least €150,000

3.

Purchase a residential real estate with a

minimum value of €350,000, or lease a residential real estate in Malta for five

years, at an annual rent of at least €16,000

4. Get a global health insurance coverage of at least €50,000, for all named applicants

How much has to be added

to the contribution per dependent?

Answer:

·

Spouse: €25,000

·

Each dependent child 0-17 years: €25,000

·

Each dependent between 18-26 years, single and

financially dependent on the primary applicant: €50,000

·

Each dependent aged 55 or over, residing with

the main applicant and financially dependent on the applicant: €50,000

What is the minimum

investment term? Can I sell my property after that term without buying/leasing

a new one? Is it the same with the RBI program?

Answer: The citizens must maintain the investments (bonds + real estate ownership or rental) for five years. Regarding the residency by investment program, the investor must keep the investment for at least five years either until he or she becomes a citizen or decides to change the resident status.

What are the associated fees to apply for the CBI program?

Answer:

Due Diligence Fees:

·

Principal applicant: €7,500

·

Spouse: €5,000

·

Each Dependent child aged 0-17: €3,000

·

Each Dependent aged 18-26: €5,000

·

Each Dependent aged 55 or above: €5,000.

What are the financial

requirements of the RBI program?

Answer:

·

Investments in highly reliable Maltese

government bonds of €250,000, for 5 years

·

Contribution to the State Fund of Malta in the

amount of €30,000.

·

Purchase or rent a property in Malta for

residential use.

1.

Purchase: not less than €320,000 for a property

situated in the North of Malta, or €270,000 for a property located in Gozo or

the South of Malta.

2. Rental: €12,000 per annum for a property situated in Malta; or €10,000 per annum for a property located in Gozo or the south of Malta).

Do the RBI program's

contribution and fees cover the whole family?

Answer:

The €30,000 contribution covers the main applicant, spouse, and children of the main applicant/spouse at the application stage. A further contribution of €5,000 is applicable for every parent or grandparent of the main applicant or spouse at the application stage.

What are the associated

fees to apply for the RBI program?

Answer:

There is a non-refundable due diligence fee of €5,500.

How much of the total

investment must be paid with the application in both cases? Do I have to pay

for the property, make the contribution, and invest in bonds before applying or

only after receiving an approval?

Answer: As an official agent of the Maltese investor's immigration programs, we help the clients to prepare the proper documents for the application. For the citizenship program the investor must also transfer the professional fees, the government due diligence fees, a non-refundable contribution of €10,000 as a partial payment of the NDSF contribution in exchange for the Letter of Approval in Principle".

Within four months of the Letter of Approval in Principle, proof must be submitted to Identity Malta that the applicant completed the real estate purchase or fulfilled the lease, as well as completed the requisite €150,000 investment required by law.

Once the Letter of Approval in Principle has been issued, Malta Immigration will be able to grant the applicant and family members a National Visa (for a period of 90 days). It allows them to visit Malta to take the Oath of Allegiance, complete any property viewings to purchase and provide their biometric data (fingerprints and iris scan).

If the

applicant met all the conditions, within two years but not earlier than six

months from the date of the application, the authority issues the Certificate

of Naturalization, which is needed to obtain the passports.

For the residency, a non-refundable €5,500 fee must be paid. When the Letter of Approval in Principle is issued, the €24,500 contribution is due.

Is the donation to the

NDSF refundable?

Answer: Donation is not refundable.

Are the RBI beneficiaries

required to live in Malta for a determinate time per year?

Answer: The minimum number of days to be spent in Malta is not specified.

Must the CBI applicants live in Malta before, during, and after the application?

Answer:

The minimum number of days to be spent in Malta is not specified. Citizens of Malta can live, work or stay, wherever they want to.

In which steps of the

process, the applicant must be physically present in Malta (in both programs)?

During the process, the applicants must visit Malta to provide their biometric data, and they must personally pick up the passports.

Are the names of those

approved in the CBI program published somewhere?

Answer:

The Government of Malta every year publishes the names of all foreign citizens who naturalized for citizenship in the official Gazette. The Gazette publishes the names of all naturalized citizens and IIP citizens combined in December of the following year.

Does Malta recognize dual

citizenship? Can citizenship be revoked?

Answer:

Malta recognizes dual

citizenship since 2000.

Yes, the Maltese citizenship can be lost through deprivation if:

1. The citizenry was acquired

using fraud, false representation or the concealment of any material fact.

2. The citizen has shown

himself or herself by act or speech to be disloyal or disaffected towards the

President or the Government of Malta.

3. The citizen engaged,

unlawfully traded either communicated with an enemy or associated with any

business motivated by the willingness to assist an enemy in a war.

4. The citizen has, within

seven years after becoming naturalized as a Maltese citizen, been sentenced to

a punishment of not less than twelve months in prison.

5. The citizen has been ordinarily resident in foreign countries for a continuous period of seven years. During such time, he or she has neither been in the service of the Republic or of an international organization of which the Government of Malta was a member nor given a notice in writing to the Minister of his or her intention to retain citizenship of Malta.

Malta has one of the

stringiest due diligence processes among the CBI and RBI programs. How can

Discus Holdings guarantee success to their clients? What's your success rate in

Malta?

Answer:

Our headquarters is in Malta; we are a local company there with the experience of long years. Our success rate is 100% because our clients must go through a strict preliminary due diligence check. It is our responsibility to prepare the documents and the applicants for the process, and we do our job very well.

Is Discus Holdings a

government-licensed service provider in Malta?

Answer:

Naturally, Discus Holdings was among the first immigration and investment consultancies to obtain the license from the government, you can check it on the official list of service providers in the relevant section of the Identity Malta's website.

What do you offer over

other providers in Malta? Why should a client pick Discus Holdings?

Answer:

Most of our competitors entered the citizenship and residency by investment sector only a couple of years ago. Meanwhile, our colleagues have more than 25 years of experience. Even before the trend of obtaining second citizenship started, we have been already one of the leading European company forming and tax planning service providers in Central Europe. We have the contacts, and we are official agents of the programs. We take the success of your application personally. Ask for a free consultation to check the quality of our service.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

From all the structures dedicated to protecting one's assets, the trust has been consistently the fa...

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...