Banking and Real Estate: How to Use Panama Residency to Build International Assets

Understanding the Basics of Opening a Bank Account

Having an international bank account can open doors to real estate investment, to saving in foreign currencies, or facilitate business transactions. Furthermore, if you open a bank account, Panama residency can be much closer to you, allowing you to prove your solvency.

In this article, we delve into Panama banking and its advantages, such as diversification, solid solutions, excellent online banking, and top-notch international services.

Who Can Open a Bank Account in Panama?

Any foreigner or Panamanian can open a bank account as long as they prove their source of funds and their identity. Some institutions allow for a full online procedure, which turns out to be convenient since it saves the client from the hassle of traveling.

Types of Bank Accounts Available

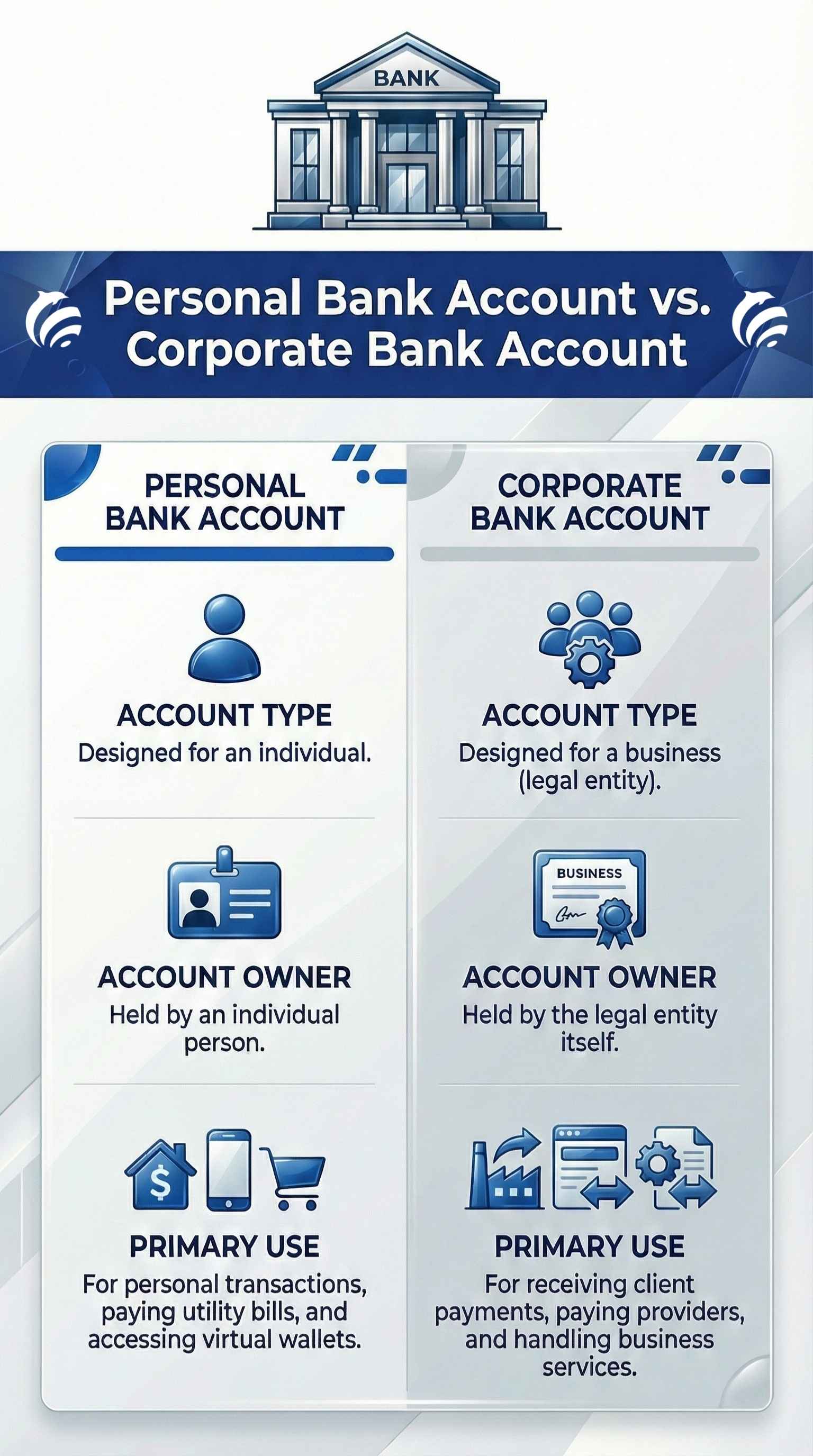

- Personal account: The owner of this account is an individual, and the funds are used for the person’s needs: transactions, payments, utilities, access to virtual wallets, and so on

- Business account: the owner of the account is a legal entity, and the account is used for all the needed transactions; paying for providers, paying for services, receiving payments from clients, or receiving payments from providers

- Investment account: the goal of this account is to invest; it's opened by those who operate in stock markets, forex, and related sectors.

- Savings account: This is a personal account whose main purpose is to safeguard money. Due to their nature, these accounts usually offer higher interest.

- Current account: while being a personal account, its main goal is making payments and transactions, and it's characterized by having high liquidity.

Requirements for Opening a Bank Account

Identification Documents

At the risk of stating the obvious, to open an international bank account in Panama, a person must prove his/her identity, and a company must prove its existence.

For individuals, international banks in Panama ask for two different IDs, which are usually the passport and the national ID, and sometimes the driver's license.

Proof of Address

The applicant must prove where he/she lives, which is done through a utility bill (electricity, phone, water, or any other services)

Bank or Professional References

The bank is taking responsibility by accepting a new client; hence, they must confirm the person's good character. This is done through letters issued by third parties:

Bank references: applicants must ask their previous banks to issue a bank reference letter stating how long they have had the account, and in some cases, the balance.

Professional References: A letter written by a colleague who has to have a respectable position in his area of business, stating that he knows the client.

Proof of Funds / Source of Income

This is one of the key points, as banks want clean money. It is the client's money the one that will be running through the bank, and they need to make sure that it comes from legal sources and from reputable businesses or activities.

Initial Deposit / Minimum Balance

Now we can move on to the funds themselves. It's imperative to differentiate the minimum balance of the initial deposit.

Initial deposit: Most banks demand a certain minimum sum at the time of opening the account. The amount will depend on the bank's conditions. Nevertheless, this shouldn't be mistaken for the minimum balance.

Minimum balance: some banks require a minimum balance to keep the account open, which can be the same as the minimum deposit or not. If the minimum deposit is higher, then the client can proceed to make all the transactions he desires as long as the funds don’t fall under the minimum balance.

The Account Opening Process

Timeline for Account Opening

The longest stage in the process is the gathering of documents. Once submitted and approved, the process can take from a few hours to a few days.

Step-by-Step Process

- Survey the available banks

- Contact your Mundo expert

- Choose your bank

- Pay the legal fees

- Gather the documents together with the expert

- Fill out the forms with the help of your expert

- Mundo’s experts will submit your application and documents

- Receive your account information, including the account number

- Set up your online banking

- Ask for additional services (debit and credit cards are the most common ones)

- Proceed to make investments, transfers, or save your money in the new account

Best Banks in Panama for Foreigners

Overview of Top Banks

All the top banks in Panama have the same characteristics in terms of international banking needs, and they are all based on solid financial licenses regulated by the Republic of Panama. We don't mention the names of the banks in our articles because these institutions like to keep a low profile. Anyway, as soon as you reach out to one of Mundo’s experts, you will know the available alternatives.

One of the most solid bank institutions was founded in 1955, and it's known for its strong reputation, wide array of services, excellent customer support, and reliable online banking. It’s known for having an extensive network across the country with plenty of ATMs and branches to approach at your convenience. They can be in shopping malls, in pharmacies, in stations, and naturally at the banks.

Another reliable bank is an institution founded in 1994 and headquartered in Panama City. Their approach is focused on clients, providing a variety of solutions for both companies and individuals, including investment management.

More information about bank accounts

Advantages of Opening a Bank Account in Panama

Tax Benefits

Panama is usually seen as a low-taxation country; however, it's important to note that opening a bank account in Panama doesn’t bring tax benefits per se. Panama’s main perks as a tax jurisdiction come when you have funds outside of Panama while living in Panama (because the country doesn't tax foreign income).

Dollar-based account

Even if your balance is in Balboas, the official currency, it's actually in U.S. dollars as the Balboa is pegged to the American currency. Actually, the US dollar is the legal tender in Panama, and you can use it for anything, from buying groceries to paying for a movie ticket or buying a real estate property. The balboa is only issued in the form of coins, so all the bills you’ll see will be US dollars.

This constitutes an outstanding opportunity to hold cash in a strong currency, make international transactions easier, and avoid unnecessary exchange fees.

Confidentiality and Asset Protection

Panama is committed to international confidentiality standards. This means that the bank keeps the names of the account holders confidential to the public; however, under CRS, they will be automatically reported to the account holders' tax residency country/countries.

Access to International Banking Services and Ample Business Hours

One of the best aspects of banking in Panama is having access to state-of-the-art facilities and the possibility of managing the account from anywhere in the world. A very convenient aspect is the ample working hours, which are not that common in other countries.

Opening times to the public may vary depending on the bank and the branch; some of them work from 8 am to 3 pm or 5 pm, and some from 8 am to 9 pm. This provides ample possibilities of visiting the bank to cash checks, ask for letters, ask for credit and debit cards, report lost debit or credit cards, change one’s personal information, or address any issue.

Challenges and Considerations

Common Pitfalls to Avoid

One of the main obstacles that may arise is related to foreign applicants. Without a Panamanian resident card or a cedula, getting accepted can be hard. This is why it's always recommended to approach experts like the Mundo team, since they know the banks and can guide you in the right direction. This saves you from wasting time and reduces the chances of rejection.

The importance of pre-approval

Pre-approval is a common procedure when opening a bank account through a third party. It consists of choosing several potential institutions, and, consequently putting together a unified package to send to all. This can provide an earlier outlook as to what options are actually available and worth your time.

Legal and Regulatory Considerations

All the banks in Panama are regulated by the Superintendency of Banks of Panama, ensuring a solid framework for the banking activities to develop and a safe environment for foreigners. The first two important banks were created in 1904, very close to the country's independence from Colombia.

Over the years, new players appeared and became instrumental in supporting industrial, commercial, and agricultural activities in the young country. Nevertheless, the first banking law would be approved over half a century later, in 1970.

By the end of the decade, there were already 21 banks operating legally under the new law. Interestingly, this move was made with the purpose of attracting foreign banks to Panama and leveraging its position as a bridge of the world. Sixty years later, it’s nice to see how these efforts paid off as Panama flourished into a banking and financial hub and an attractive destination for expats.

Managing Your Panama Bank Account Remotely

One of the best advantages is the possibility of opening an account online and managing it remotely. Especially in the largest banks, online banking services are quite advanced and allow you to manage all operations from abroad. When there's an issue, there are customer services available through their websites’ chats, through the applications, or via WhatsApp.

FAQs About Opening a Bank Account in Panama

Is the money in the account free of tax?

No. Whatever money you receive and hold in Panama is taxed in Panama. Moreover, you can be taxable in other jurisdictions for your cash in Panama, according to your tax residency status.

Can I open an account remotely in Panama?

Yes, however, not in all banks. We recommend contacting your Mundo expert right away and consulting about it.

Is it difficult to open an account in Panama as a foreigner?

Yes, as the banks will expect a residency card or a Panamanian cedula. If you are considering applying for Panama residency, we recommend opening an account after approval. With a resident card, plus all the stipulated requirements, almost any bank will welcome you.

Will the account help me obtain Panama residency?

No, yet in the process of obtaining residency, it is necessary to open an account and deposit funds as proof of solvency.

Final Tips Before Choosing a Bank

At the end of the day, Panama has an excellent banking environment for expats, offering everything that an individual or company needs. While it is easier to open an account being a resident, there are options for non-resident foreigners and companies who want to leverage this dollar-based economy and business-oriented country.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...

In Panama, the real estate market is significant because of its convenient costs and the permanent r...

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's i...