How to Combine a Panama Residence Permit with an International Bank Account

Why Open an International Bank Account in Panama?

When it comes to Panama residency, banking plays an important role, whether it is for proving solvency or making a fixed deposit. For expats, opening an account in Panama can mean significant leverage in the international business sphere. So, let's delve into banking in the country of the canal, its benefits, characteristics, and requirements.

Benefits of Having a Bank Account in Panama

From political and financial stability to the availability of world-class services, Panama constitutes an outstanding banking jurisdiction. One of its most interesting advantages is its currency, which is paired with the US dollar. Even though the official currency is the Balboa, the money used daily and in day-to-day transfers is the US dollar.

Best Banks for Opening an International Bank Account in Panama

It is our policy not to mention the names of the banks except during formal and personal consultations. Nevertheless, we have prepared an overview of the top banks in which you will see all of their characteristics except for their names. When you're ready to open your account, you can talk to your Mundo expert, and they will provide you with further information.

Overview of the general services you will find across banks in Panama

- Personal account

- Corporate account

- Personal accounts for foreigners

- Digital token

- Investment funds

- Possibility to hire insurances

- Savings accounts

- E-commerce solutions

- Online banking

- Customer support

- Investment banking

- Promotions

- Loans

- Debit cards

- Credit cards (Visa)

- Credit cards (Mastercard)

- Credit cards with benefits according to specific interests (travel miles, frequent traveler benefits, support of sustainable projects, payment of monthly services and streaming apps, benefits for shopping in certain stores)

- Corporate and strategic advice

- Asset structuring

- International financing

Top Banks Overview

A leader in Panama and the banking industry

We work with some of the best banking institutions in the country, and this one is not the exception. With almost four decades of providing services to foreigners and locals, this is one of the three most profitable banks in Panama. It provides all kinds of accounts, including e-commerce solutions.

All kinds of services in the country of the canal

There is another option that's outstanding for those who need comprehensive services beyond obtaining residency. This institution provides online banking, debit cards, and e-commerce options. Also, Panamanians and residents can hire insurance services directly through the bank, thus simplifying processes. Finally, it provides convenient payment solutions for businesses.

Protect savings and be part of the future in Panama

With already a quarter of a century established in Panama, this institution stands out because of its commitment to sustainable development and local growth. It has set forth initiatives such as educational programs for investors and corporate well-being programs. They take part in carbon reduction projects and they openly support gender equality and female leadership.

International hub for banks from all over the world

There are plenty of international banks that have chosen Panama as their headquarters because here they find a fertile soil for growth. Being home to the Panama Canal and having gained control over it for over 20 years now, Panama has become a business-friendly jurisdiction and a magnet for foreign investment and talent. According to the Panama Superintendency, there are 25 foreign banks operating with a general license and 12 Panamanian private banks. Together, these groups constitute the majority of the institutions.

Comparative Analysis of Bank Services

The table below shows info for personal accounts unless specified otherwise. Please consider that this DOES NOT include legal service fees.

Minimum Balance | Minimum deposit | Minimum deposit | |

Option 1 | 5,000 | Not required | Not required |

Option 2 (current account for private banking only) | 50,000 | 1,000 (locals) | 1,000 (foreigners) |

Option 3 (current account) | Consult | 500 (local, individual) | 1,000 (company) |

Option 4 (international account) | 3,000 | 3,000 | 3,000 |

Option 4 (regular account) | 50 | Not required | Not required |

*Option 5 | Consult | 50 (locals) | 3,000 (foreigners) |

*Option 6 | 50 | Not required (locals) | 3,000 (account with advanced benefits, locals) |

*Option 7 (current account) | Consult | 300 (locals) | 300 (locals) |

The options marked with * are not offered at the moment by Mundo and are listed only for the sake of comparison.

Disclaimer: the numbers stated in this table may be outdated at the time of reading. Also, these options may not be available at the time of reading, as we are always changing to improve our services. This article doesn’t constitute banking advice. For banking advice, consult with certified professionals.

Brief Conclusion

As we can see from this table, current accounts are more expensive, and the minimums increase for foreign clients.

Requirements to Open an International Bank Account in Panama

Identification Documents

Those who want to open an account will need to provide an ID. For Panamanians, they request the cedula, for foreign residents, they request a foreign cedula (cedula E) or a resident card. On the other hand, foreigners who don't reside in Panama will have to present a passport and a second ID.

Proof of Address

Applicants must submit proof of address, which can be a leasing contract, a service invoice, or a bank account statement.

Bank or Professional References

Future account holders must submit a letter stating a professional reference from a trustworthy member of the sector. Some banks ask for two reference letters if the applicant is a foreigner, which must be issued in the applicant's country of residence. If it's a banking letter, the relationship with the bank must be at least a year old.

Proof of Funds / Source of Income

This can be leasing contracts, financial statements, payment receipts, payment receipts from providing services, a document that states the applicant's participation as a shareholder in a company, a reference letter indicating the ownership of investment accounts, or other documentation that the bank considers relevant.

Initial Deposit / Minimum Balance

Not all banks require an initial deposit or to keep a minimum balance. In any case, the initial deposit can start from $1000 for foreigners and rise to 3,000 or more. This will entirely depend on the chosen institution.

The reader should consider that the minimum balances and the initial deposits are usually larger for foreigners, investment accounts, or advanced savings accounts.

Important note: We listed the requirements that are generally asked for in this type of service. Nevertheless, each bank and jurisdiction establishes its own requirements and can ask for additional documents or specifications. The definitive list of requirements will be provided on a case-by-case basis and during formal consultations.

Can I Open an International Bank Account Remotely?

Yes. Fortunately, in Panama, it's possible to open an account 100% remotely, which is extremely convenient for people who are busy or who can't travel.

How Long Does It Take to Open a Bank Account in Panama?

The time frame for opening the account will entirely depend on the case. The sooner the applicant presents clear and complete documentation, the better. Then they will have to wait for the bank to conduct due diligence. For a more precise time frame, according to your case, contact the Mundo team.

Managing Your Panama Bank Account Remotely

Managing your account remotely is completely possible and safe. With security tokens and excellent remote support, account holders can make transfers, check balances, and pay for credit cards and services right from the app.

Important Considerations for Foreigners

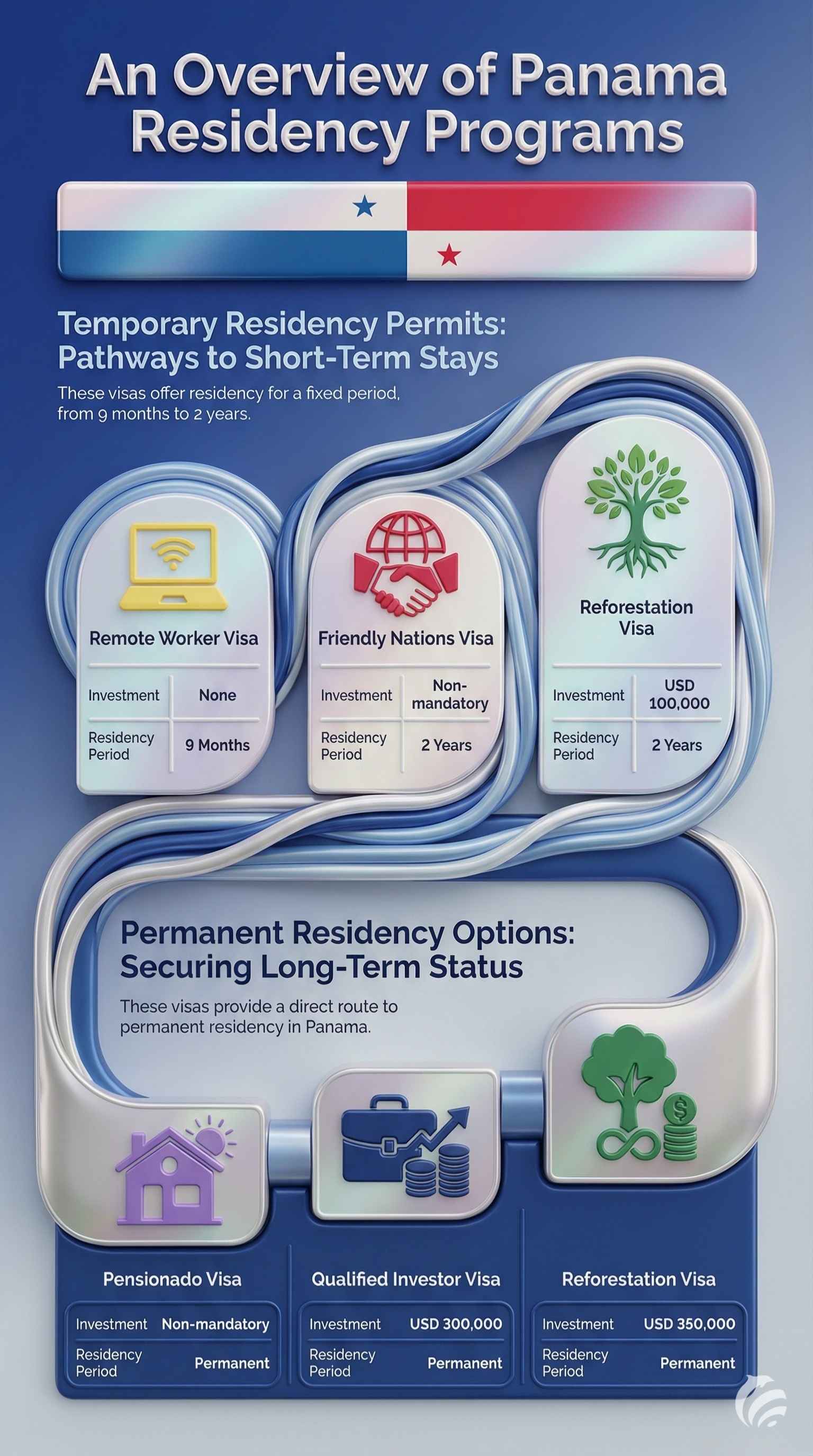

At the risk of sounding too obvious, foreigners with residency in Panama have an ample array of options to choose from. This gives them an advantage because residents can select banks with lower rates and more convenient conditions. As you can see from the graphic below, in the country of the canal, residency is relatively easy. You will find plenty of programs offering from 2-year permits to limited nine-month visas and immediate permanent residencies.

Banking and residency

Nevertheless, having a bank account is important during the residency process as well, as many programs require proof of solvency through a temporary deposit in a local bank. The Friendly Nations Visa, targeting citizens of specific countries, requires this. Anyway, you can implement this with your Mundo expert if you decide to obtain residency.

Permanent residency through a fixed deposit

There is one program besides Friendly Nations that is closely connected to banking: the Qualified Investor. One of the entries is a fixed-term deposit of $750,000 into a local bank account. In the same way, if you choose a real estate option, you may have to use a local bank account. In such cases, the Mundo team recommends banks that can serve this purpose specifically, without unnecessary extra costs.

Banking and Panama residency

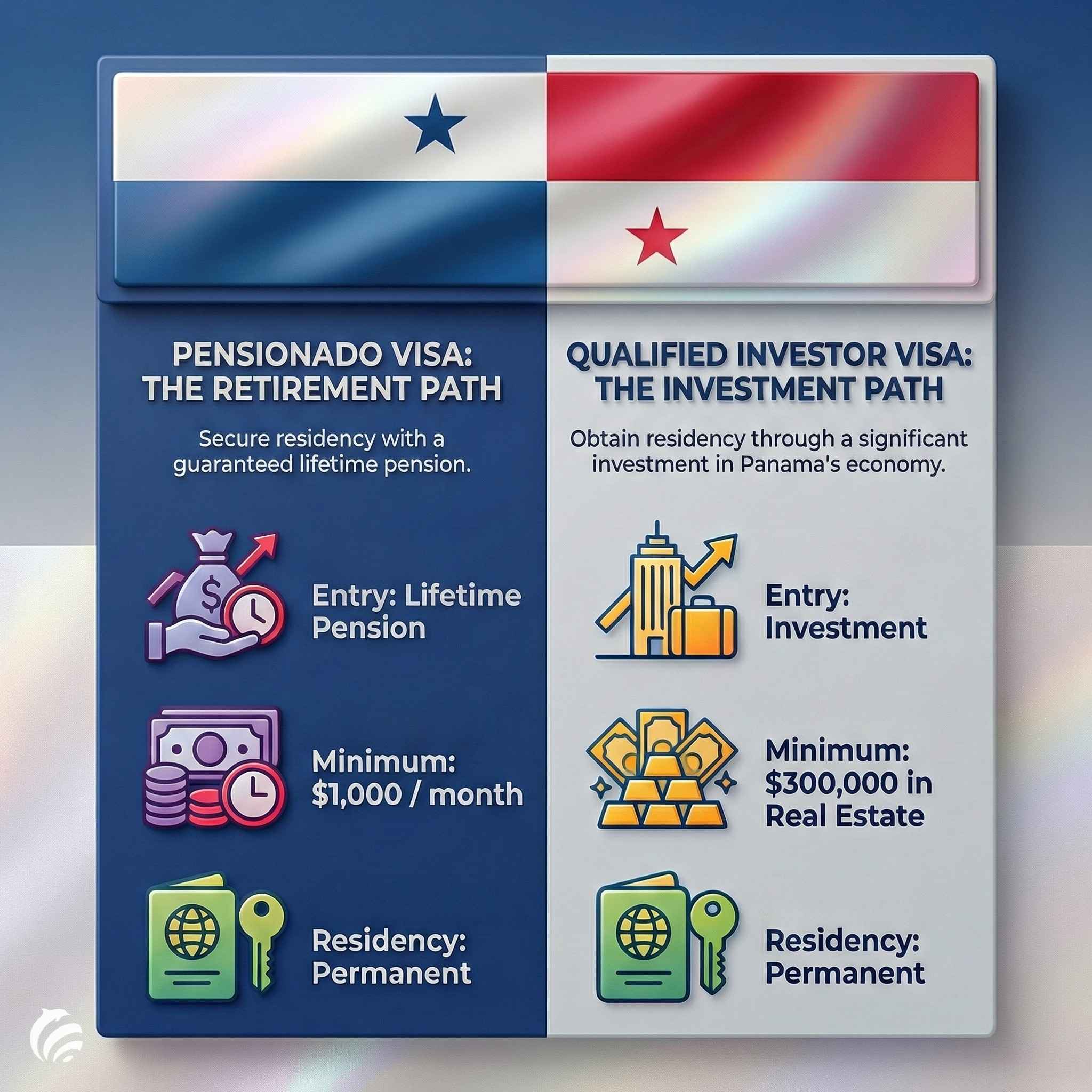

Pensionado: a path to optimal retirement

When you obtain your Panama residency, you're going to open a bank account eventually and one of these programs is focused on retirement. Those who receive a pension income of $1000 a month can obtain permanent residency through the pensionado visa and include the spouse and children in the process.

The main condition is that this pension must be for lifetime, regardless of the source (private or government-based).

For those who have this pension, this is one of Panama's best alternatives, as it comes with several social benefits, including discounts in healthcare, medicine, entertainment, hotels, tourism, and restaurants. Furthermore, there's a possibility to lower the monthly pension to 750 by making a $100,000 investment in real estate.

Pensionado visa advantages at a glance

- Ample array of benefits

- Relatively low threshold

- Possibility of lowering the pension to $750 by acquiring a real estate property

- Exemption on imports of new cars (in stipulated periods)

- Exemption on custom charges when bringing personal items from abroad, like furniture

- Possibility to apply with a spouse and children

- Permanent residency

- Possibility of obtaining a work permit

- Discounts on flights and hotels (higher discounts during weekdays and low season)

- Discounts on medicine and healthcare

- Discounts on restaurants, cinemas, and other activities related to entertainment

- Investment is not mandatory

- One of the most cost-effective programs in the region

- Excellent cost of living/lifestyle ratio

- Vibrant nightlife and active social life

- Access to a country with tropical weather and dreamy coastal landscapes

- Beaches on the Pacific and the Caribbean Sea only a few hours away from the capital

- Dollarized economy

- Advanced infrastructure and world-class real estate

Invest in Panama: immediate permanent residency thanks to Qualified Investor

On the other hand, Panama has its own version of the golden visa providing an opportunity to obtain immediate permanent residency. The entries are through real estate (a minimum of $300,000), investment in the local stock market (minimum of $500,000), and the above-mentioned fixed term deposit (a minimum of $750,000).

The main advantage of the Qualified Investor over other investment approaches (like reforestation visa) is that it grants immediate permanent residency through vehicles that allow you to obtain short-and-mid-term benefits.

The cheaper option of $300,000 requires the purchase of a property that can be used as the residence for the family, a rental income source, or a combination of both.

A Comparison: Pensionado against Qualified Investor

Tax Advantages of Opening an International Bank Account in Panama

Aggressive publicity may be misleading; hence, it is imperative to understand that having a bank account in Panama does not bring any specific tax advantage. The tax advantages in Panama consist of lower personal and corporate income tax compared to other jurisdictions, and incentives for companies registered in the free zone.

An important aspect of this country is territorial taxation. This means that, if you have tax residency in the country and receive income abroad, such income is free of tax in Panama (only in Panama, but not necessarily in other jurisdictions). So, if you open an account and hold your savings in Panama, you may be taxable.

Final Tips Before Choosing a Bank

We’ve put together the main points in the following list for easier grasping:

- Consult with your Mundo expert because he/she has plenty of experience opening bank accounts and can help you find the right solution faster

- Clearly establish your goals for this account (investment, savings, payments, e-commerce, residency application)

- According to your goals, analyze the different options available and the one that fits best

- Analyze the minimum deposit and the initial costs

- Consider long-term expenses and conditions (minimum balance, maintenance costs, transfer fees)

- Consider long term benefits (access to special programs through credit cards, debit cards that allow you to withdraw cash abroad, interest rates, fixed deposits, etc.)

FAQs about Opening a Bank Account in Panama

What are the primary benefits of having a bank account in Panama?

The main advantage of banking in Panama consists of its dollarized economy. For Americans, not having to spend on exchange fees is a plus, and the same goes for those who are interested in international transfers, as the US dollar is used globally. Besides, the country stands out for its political and economic stability and robust banking sector.

What are the requirements for opening a bank account as a foreigner?

For most incorporations or bank account openings, the person has to prove: his/her identity, where he/she lives, that the source of funds is legal, and having good character (not being involved in illegal or shady businesses). From these basic points, every bank can impose other requirements or ask for specific or additional documentation.

Is Panama a member of the CRS?

Yes, which means that at the time of application, you will have to state your country or countries of tax residency. Subsequently, the bank will ask you to confirm this information regularly and update it if it changes.

Can I include my family members in my application for a bank account?

In general, bank accounts are personal. Although some banks offer savings accounts for kids with specific conditions, this will have to be arranged on a case-by-case basis.

Final thoughts on Panama banking and residency

Thanks to its cosmopolitan environment and business-friendly initiatives, Panama has been attracting expats who want to live here, obtain residency, or simply bank. With several reliable institutions, this is one of the best banking hubs in the region, having, as its most relevant feature, a dollarized economy.

Contact the Mundo team and discuss your case so we can provide updated and specific requirements for the institution that will help you achieve your goals. Get in touch now and start the process of owning your bank account in Panama.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

The country of the canal has consistently been chosen as an expat and real estate destination. With ...

There is good news for global citizens: with a minimum investment, Panama citizenship is available (...

From all the structures dedicated to protecting one's assets, the trust has been consistently the fa...

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...