The Five Flags Strategy in 2026: How US and Canadian Citizens Can Optimize Global Freedom

What is the Five Flag Theory or Five Flags Theory Explained

Talking about the five-flag theory is talking about wealth and how to preserve it for generations. More than a strict set of rules, this is a philosophical concept that encompasses a second residency/citizenship and financial optimization across five countries or flags.

The earlier foundation of the theory was established by Harry D. Schultz, and it was soon embraced by wealthy families throughout the decades. Entering the second quarter of the century, with geopolitical conflicts and other concerning threats rising, we believe that the five flags are more vital than ever.

Understanding the Five Flags

There isn’t a one-size-fits-all concept regarding the flags, instead, they have been adapting while always maintaining the same principles.

1. Citizenship and Passport

It all begins with establishing a second citizenship that will provide protection for the investor and the family. Having a second passport opens the doors to new countries, which can be especially convenient in times of crisis.

Whether it is a personal issue or one concerning the region, having a second citizenship can help. For a quick example, let us remember the times of the COVID-19 pandemic. When the borders closed, no person was allowed in unless they were citizens (in some cases, not even residency was enough).

2. Legal Residency

A common misconception is that the country of citizenship must be the same as the country of residency.

According to the five flags, citizenship and legal residency have to be in separate nations. It is vital to establish legal residency in a territorial taxation country. In simple words, you will be living in a country that doesn't tax foreign income and will maintain your income abroad.

It's worth noting that this scenario is possible thanks to the CBI programs’ flexible conditions. Some programs, like Sao Tome, offer ultimate flexibility when it comes to minimum stay requirements.

As for the Caribbean countries, they are discussing the implementation of minimum stay requirements, yet they will still be far from requiring permanent physical presence.

Furthermore, the countries have made advances regarding flexibility in other aspects. For example, Saint Kitts and Nevis recently changed its minimum real estate investment from 400,000 to 325,000, and they are allowing dependent children over 18 years without mandatory studying conditions.

3. Business Base

You need a source of income, and this should be chosen carefully and smartly. When establishing a structure for your company, there are several aspects to consider, as we can see from the following list.

Main factors for choosing the business base country:

- Flexibility of the jurisdiction

- Political and economic history

- The country's currency

- Corporate taxation rates

- The existence of financial incentives (like tax exemptions for reinvested capital)

- Repatriation of funds, regulations

- Territorial, worldwide, or residency-based taxation

- Location and access to markets

- Purpose of the structure (business, consultancy, holding)

- Economic substance and BEPS requirements

- Structure of the company (LP, LLC, BC, partnership)

4. Asset Protection

None of the other flags will be safe without the 4th flag. Asset protection structures consist of entities or agreements that separate the original owner from having legal ownership over the assets. This move, if correctly done, can make the difference in protecting everything you have worked for. There's no need to be fatalistic, but the truth is that what is built throughout our lifetime can be destroyed in a day if it falls into the wrong hands or is subject to ill-intended people.

What structures to choose?

While the previous ones were for optimization, this one is for protection. The asset protection structures per excellence are mainly two: trust and foundation. For an overview of their key differences, please check out the following graphic.

For this, the ideal jurisdictions are Nevis (for trusts) and Panama (for foundations).

5. Lifestyle Base

At this point, it's vital to consider that you will have to spend most of your time in your country of tax residency. In general, jurisdictions consider tax residents those who live at least more than six months a year within the territory. Therefore, the chosen destination must be carefully studied in advance.

Advantages of Panama as your lifestyle base

- Cosmopolitan environment

- Plenty of international schools (English-speaking, French-speaking, German-speaking, etc)

- Tolerance when it comes to religion and cultural differences

- Advanced infrastructure

- Excellent lifestyle and vibrant nightlife

- Outstanding coastal destinations starting one hour away from the capital

- Mild weather in places like Boquete

- U.S. dollar is the legal tender

- Ample array of programs to obtain legal residency

- Business-friendly environment

- Free zones and special economic zones offering incentives

- Strategic location and time zone (close to the main capitals of the Americas and with direct flights to Europe)

Conclusion: diversification is priority

Now that we have explained the five flags, we understand why they are coveted by Americans, Canadians, and others from high-tax zones. Nevertheless, we shouldn't miss the actual goal of the theory, which is achieving diversification in all aspects. With this clear objective in mind, the flags can be adapted on a case-by-case basis.

Modern Adaptations of the Five-Flag Theory

Cryptocurrency and investment

Some are adding cryptocurrency and traditional investment as a sixth flag. A well-crafted portfolio can bring extra income to support the structure.

Digital nomad

The advancement of digital and wireless technology has made remote work viable, especially in the past years, constituting a lifestyle for many. As a result, countries like Panama are setting remote worker visas with flexible conditions and requirements, which cater both to freelancers and business owners as long as the activity happens outside of Panama.

Benefits of the Five Flag Theory

Tax Efficiency and Wealth Growth

Thanks to the five flags, expats can achieve the ultimate optimization of their financial affairs because they will be using each flag to their advantage.

The establishment of a company in the right jurisdiction (what 20 years ago you may have called “offshore companies”) and a duly structured tax residency can take you to the best place when it comes to growing and protecting your assets.

Global Mobility and Freedom

Global mobility cannot be separated from the five-flag theory. When taken to its highest level, the theory is more than an asset protection strategy: It protects the family. This is why many Americans choose to have double citizenship or even a 3rd or 4th one.

Challenges and Considerations

Common Misconceptions

The five-flag theory is illegal or shady

The theory proposes certain goals to achieve, goals that should be accomplished 100% through legal ways. This strategy is about using the available legislation to achieve maximum diversification.

The five-flag approach is for the extremely wealthy

The theory can be applied by anyone, especially mid-income and high-income individuals. The main objective is diversification and optimization of whatever assets you own, whether they are worth billions or a couple of hundred thousand.

Key Risks and Compliance Issues

The answer here is simple: there can't be any compliance issues if you do everything in compliance with the law. Do not attempt to make any illegal moves and, if your advisor proposes something in this direction, change your advisor.

Illegal practices are the opposite of the five-flag theory because not only can you lose all your money in fines, but you can also go to jail.

Disclaimer: This article does not constitute financial advice. Every action related to taxes, incorporation abroad, second citizenship, or tax residency should be carefully assessed and consulted with a specialist.

Practical Implementation of the Five Flag Theory

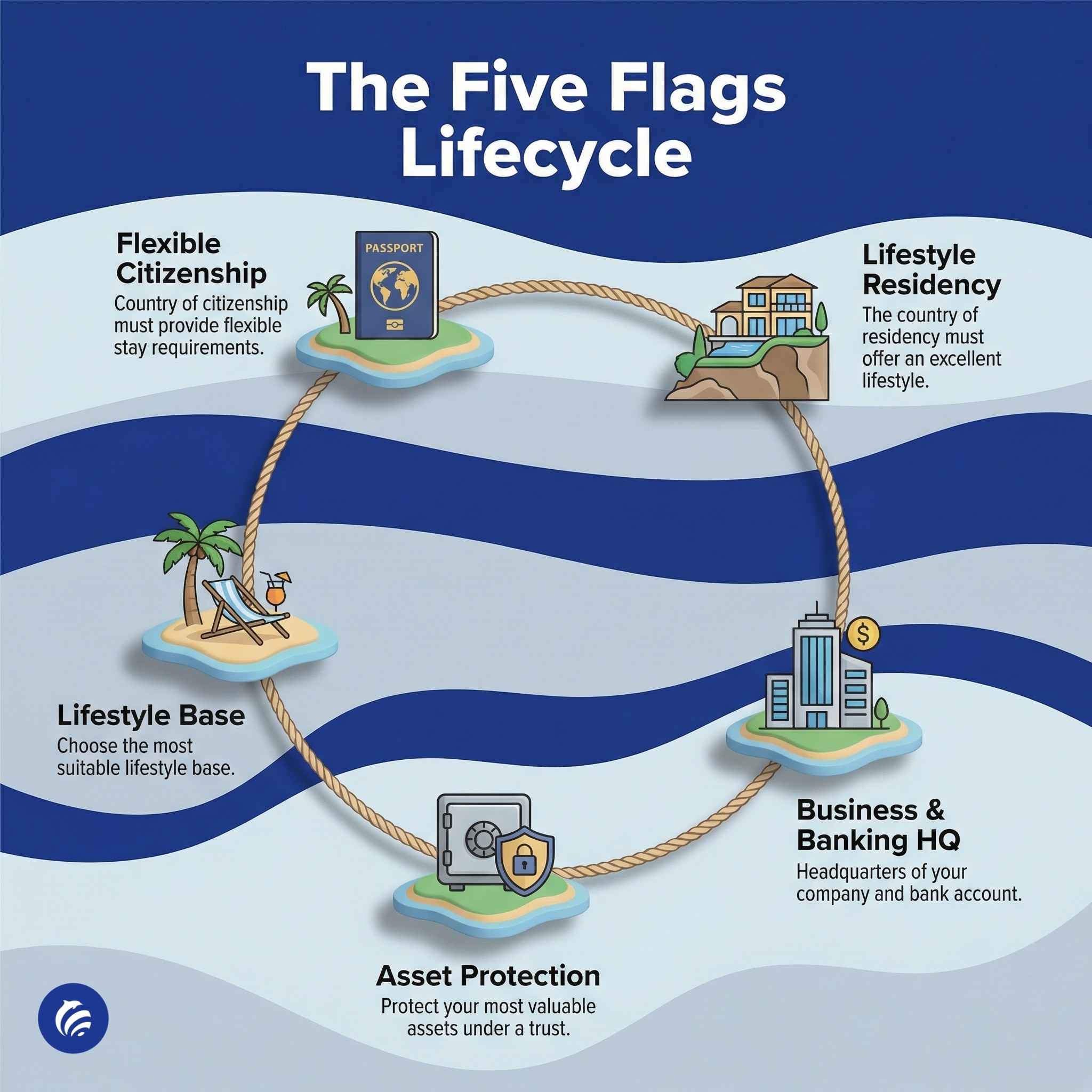

Step-by-Step Implementation Guide: The lifecycle of the flag theory for the average investor

The flags do not necessarily have to be implemented in order. If you have time, you can do them one by one, but you can also implement them at different stages or simultaneously.

Rather than a beginning-to-end process, this is a mechanism that needs to be put in motion. Before you start your car, you need more than four tiers: you need the engine, the doors, the mirrors, the electric systems, the safety measures, and the steering wheel.

The theory works in the same way, this is why we propose the following life cycle; although the reader should understand that the order of the steps may change:

- Start by researching the potential country of residency and citizenship

- The country of citizenship must provide flexible stay requirements, and the country of residency must offer an excellent lifestyle

- Set up the headquarters of your company and bank account in a friendly jurisdiction outside of your tax residency country

- Put your company, your most valuable assets, your property, and everything you want to protect under a trust (preferably in Nevis). Leave outside the trust only those assets that you want to use or sell.

- Apply for citizenship and residency in the chosen countries

- Make arrangements for your move

Business: Incorporation and Operational Considerations

For incorporation in the EU, Malta is usually a preferred choice, while Serbia, Andorra, and the United Kingdom place you in the heart of the old continent. In the Americas, Panama, Nevis, and the United States (in Delaware or Florida) are the most flexible options.

Lifestyle: Six Questions about Choosing Your Ideal Location

We believe that this point is better illustrated through the following six questions, with the last being the most important one.

- Do I see myself/my family living here in 10 years?

- What schools can my children go to, and can they fit in?

- How much is a real estate property, and what standards can I expect for that money?

- What business, entertainment, and leisure options are available?

- What is the cost of living here?

- Are there any residency programs, and am I eligible? How fast do these programs grant me residency/permanent residency?

Banking & Assets: Strategic Advantages

A bank account or several bank accounts will eventually be needed. When choosing a bank account, expats should consider the purpose, the currencies, the minimum deposit and minimum balance, the rates, the interests, and compliance. At the moment, the only jurisdiction without CRS is the United States and the US territory of Puerto Rico. Americans, when opening an account abroad, will have to comply with FATCA regulations.

Citizenship & Residency: Popular Jurisdictions and Requirements

| Country | Status | Minimum investment | Minimum entry through other means (donation, income, pension, etc) |

St Kitts | Citizenship | 325,000 | 250,000 |

Antigua | Citizenship | 300,000 | 230,000 |

Dominica | Citizenship | 200,000 | 200,000 |

Grenada | Citizenship | 350,000 | 235,000 |

St Lucia | Citizenship | 300,000 | 240,000 |

Sao Tome | Citizenship | Consult | 90,000 |

| Vanuatu | Citizenship | N/A | 130,000 |

| Panama | Permanent residency | 300,000 | 1,000/month (lifetime pension) |

Panama | 2-year residency | 100,000 | From 23,000 (your own company) |

*Disclaimer: Prices and costs may be outdated at the time of reading, so please consult with a certified professional.

Case Studies and Real-Life Examples

Hypothetical cases

Implementing the five-flag theory: case study I

Let's choose a hypothetical case, a person named John. John is American. For him, it’s only him, his wife, and his son, so he seeks a straightforward citizenship. He chooses Sao Tome and Principe because it's the cheapest option and it doesn't demand a minimum stay. With his hands free to live wherever he wants, he moves to Panama and establishes his investment accounts in another jurisdiction.

Sao Tome accepts dual nationality, but he knows that, as a U.S. citizen, he will have to pay tax in America regardless of where he lives. So, he gives up his American passport and establishes himself in Panama. Since he has chosen the Qualified Investor Visa, he obtains permanent residency for $300,000 and buys a two-bedroom apartment in a lovely neighborhood.

Now he lives in Panama and pays tax in Panama only for the money he receives here. Along the way, he has placed his assets under a Nevis trust.

Implementing the five flags: case study II

Another hypothetical case may be Maria’s. Maria is an Argentinian writer who has lived in Spain for years. She decides to take on the flags and chooses a CBI country. She has a large family, so she prefers Antigua’s CBI program.

She obtains a Friendly Nations Visa in Panama and settles here, establishing tax residency. She has arranged everything to receive her royalties in Spain, for which she will not be taxable in Panama, and gets to keep her Argentinian and Antiguian passports. Although the Friendly Nations granted her a two-year permit, she can renew it for a permanent one later.

Disclaimer: these cases are hypothetical and should not be taken as financial advice or a suggestion on what steps to take. Tax matters are complex and should be discussed with experts in every jurisdiction involved because any connection with the country can make you a taxpayer.

How Can We Help You?

Mundo is a financial publication with a consolidated team that can help you obtain any of the flags. We specialize in Nevis trusts, Panama residency, citizenship by investment, incorporation across several jurisdictions, and bank account opening abroad. Also, ask us about real estate, especially in Panama, a nation that stands out for its reasonable prices and high-end units.

Related Resources and Articles

We encourage you to check out the residency and citizenship section on our website. Check out our views on topical themes as well as useful information about the programs and opportunities.

Exploring Other Global Strategies

The five flags have been helping HNW families for generations; however, the best strategy for you is the one that fits you best. Some people may need several second citizenships, while for others, a very specifically designed trust is needed.

Conclusion: Maximizing Your Global Potential

At the end of the day, we all want the same thing: what's best for ourselves and our families. If HNWIs, wealth managers, and financial consultants have been talking about Schultz's five flags for decades, it's because they work.

In a world where offshore companies no longer exist, and regulations are getting stricter by the minute, we can still use the tools we have, only we'll have to use more clever combinations or more creative approaches. Contact the Mundo team, and tell us which flag you need help with right now.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

From all the structures dedicated to protecting one's assets, the trust has been consistently the fa...

Choosing Panama as a retirement place is convenient for many reasons. On many occasions, we have des...

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...