Why Open a Nevis Trust in 2026: Ultimate Asset Protection for US and Canadian Families

Understanding Asset Protection Trusts

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost synonymous because this island is one of the main trust jurisdictions in the world. If you browse around our articles from five years ago, you will see we have featured other jurisdictions.

Yet in the past two years, we have focused mainly on this Eastern Caribbean gem. We're not talking about offshore havens or shady ways to circumvent the law: we are talking about a serious and legal strategy that can help you even if you are not a tycoon. This is our dedicated article on the Nevis trust.

What is an Asset Protection Trust?

A trust is based on the principle of separating legal property from the original owner. This is it, and this is all that has to be done to achieve ultimate protection. This is the essence of a trust.

When you think about legal structures, you usually think about companies or entities that require incorporation. In this case, don't. The trust is a whole different structure based on British common law: a legal agreement between two parties in which one transfers the assets to the other, for control, administration, and benefit of a third party.

So, the trust is composed of the following:

- A Settlor: This is the original owner of the assets and the person who initiates the trust for asset protection

- A trustee: this is the party that will manage the assets according to the settlor's wishes.

- Beneficiaries: those who benefit from the trust’s assets. How they benefit and when depends on the original instructions, which can't be changed once established.

How a trust works

Key Benefits of Asset Protection Trusts

By giving up control of the assets, the settlor gives up the right to use them; hence, they can’t be seized. Nobody can take away something that doesn’t belong to you. So, what happens to these assets? What is the purpose of a trust if you have to relinquish control?

This is the beauty of the trust structure: you can choose who benefits from it. Generally, settlors choose family members or close friends.

Thus, you can kill two birds with one stone because you will be protecting your assets while assuring benefits for the people you love, choosing exactly how.

Common uses of trusts

A common distribution strategy is when children come of age or when they achieve a certain milestone in life, for example, if they get married or finish college. Regarding college, it can be used to pay for tuition. For parents with young children, assuring their children's education 18 years from now is an advantage that brings peace of mind, especially in our hectic and unpredictable times.

Similarly, the structure can be used for estate and inheritance planning. Nobody likes to imagine a world in which we're not in, but the truth is that death (like taxes) is unavoidable.

So, establishing this structure can help you not only with the protection of your assets but also with their distribution once you're gone. Inheritance laws vary in each country, but in general, they stipulate specific heirs by law (usually the wife and the children).

With a trust, you can leave a part of your estate, for instance, to stepchildren (who you may love even if they aren’t legally related to you), or to nieces and nephews, brothers or sisters, or simply close friends.

Better yet, you can choose what to leave to whom, while with inheritance laws, everything is distributed equally.

More information about the Nevis trust

An example of smart distribution

People are different, and so are your children. Let’s picture a hypothetical case of a wealthy person with three adult children. One is excellent for business, the other one has a large family to support, and the third one is a spendthrift. It is obvious that you won’t desire to distribute your assets equally.

So, you can leave your company to the business-oriented son, the real estate properties to the one that has many children, and provide a very tight monthly income for the reckless one.

Advantages of establishing an asset protection trust in a nutshell:

- Plan inheritance without depending on inheritance law

- Avoid unnecessary succession fees and costs

- Choose who will get what

- Leave a part of your fortune to people you love, even if they are not legally your heirs

- Resolve or avoid family disputes over inheritance

- Avoid forced inheritance

- Avoid leaving assets to irresponsible and reckless family members or spendthrifts

- Enjoy confidentiality as your name won't be in public records

- Seize perks like territorial taxation

- Make sure that your assets aren't prone to being seized or frozen

- Keep your assets safe from creditors or claims

- Keep your assets safe from people who may want to hurt you personally through your assets, like ex-spouses or former partners

- Maintain your estate safe so that your family can use it even after you're gone

Common Asset Protection Strategies

A trust is one of the components in what we call the ultimate protection strategy: the five flags. By carefully planning your affairs through five different jurisdictions, you can diversify, optimize taxation, and reduce risk exposure. Check out our featured article to learn how the Nevis trust plays a vital role in the five flags.

Nevis Asset Protection Trust

Overview of Nevis Trust

We have reached a foundational aspect of the article and the strategy. It is important to highlight that no tool can stand out purely for itself: they depend on the jurisdiction. This is very easy to illustrate with companies, an LLC, a BC, or a partnership can be opened in any place in the world, but where is it better? Where are the best conditions? If we ask this question about trust, the answer is definitive: the island of Nevis.

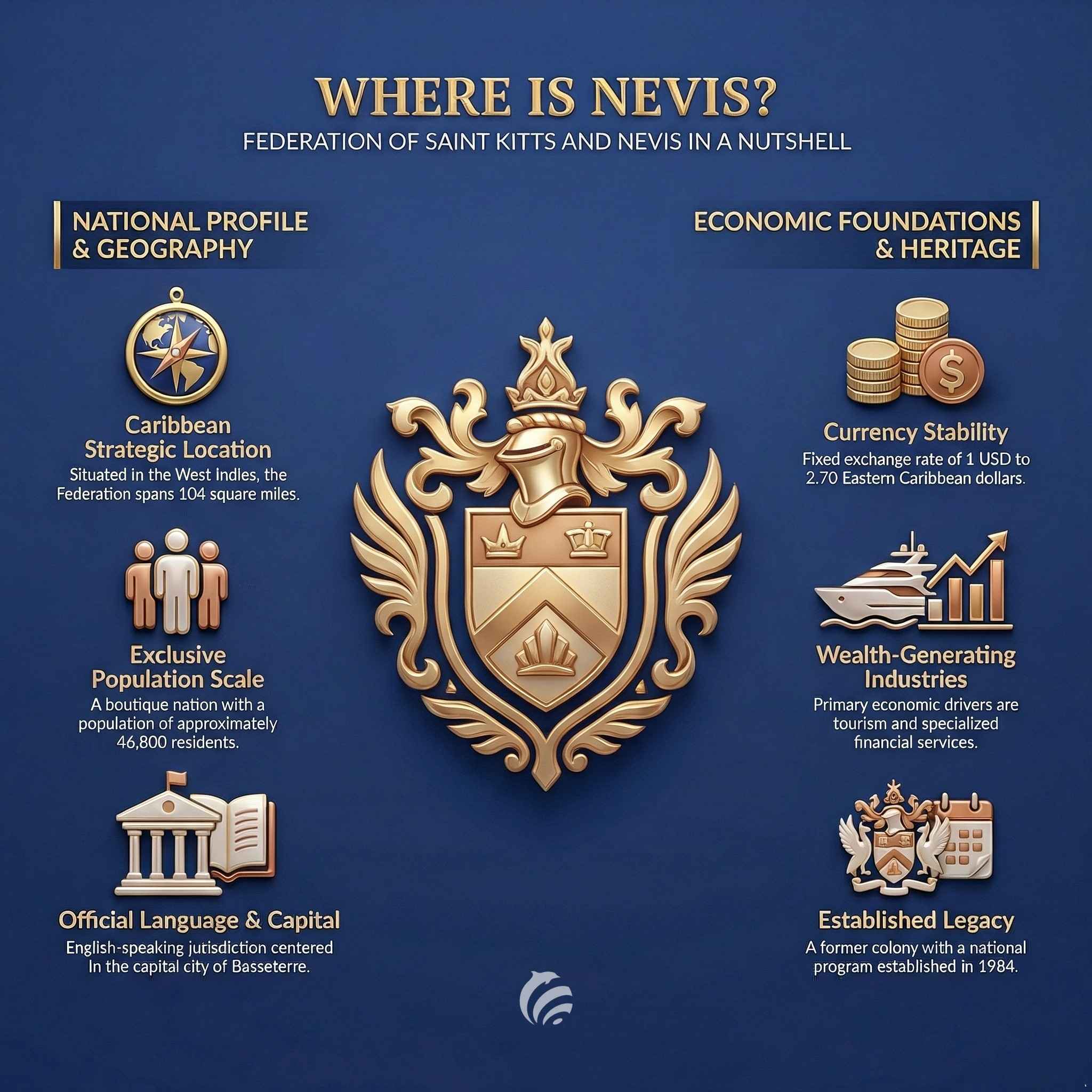

Where is Nevis

If you are new to the financial world, this may be the first time you hear about this island jurisdiction. This is an island, part of the country called the Federation of Saint Kitts and Nevis, located in the Lesser Antilles (Eastern Caribbean). This is one of the main financial centers in the region, also known for its prestigious citizenship by investment program, which is the oldest and longest-standing in the world.

Key Features of Nevis Trust

Dubbed the Fort Knox of asset protection and supported by the NIETO (Nevis International Exempt Trust Ordinance) from 1994, Nevis constitutes one of the most protective trust jurisdictions in the world. This advantage lies mainly in the fact that it doesn't recognize foreign rulings and stipulates hard conditions to challenge the trust within the jurisdiction.

A creditor will have to think twice before proceeding because he/she will have to file the claim in the jurisdiction of Nevis and pay a 100,000-dollar bond just for filing it.

Advantages of Nevis Trust

Tax Neutrality

The island works under a territorial taxation system, which means that every asset you hold here is free from worldwide income. Nevertheless, this doesn't exempt the structure from domestic taxation, and it doesn't exempt the settlor from paying tax in his home country or tax residency jurisdiction.

Short Statute of Limitations

Claims against the Nevis structure can only be filed within two years after its establishment; ergo, it becomes highly strong after such a period.

Non-Recognition of Foreign Judgments

If the creditor succeeded in presenting a claim against you in a different country, it won't be recognized in Nevis.

Differences with other structures: trust vs foundation

Although similar in essence and in many aspects, a trust must not be confused with a foundation. Please check out the differences in the following table:

| Trust | Foundation | |

Essence | Agreement | Legal entity |

| Parties | Settlor, trustee, beneficiaries | Founder, board, beneficiaries |

| Uses | Asset protection | Gathering funds for specific purposes, like charity |

Registering | Doesn’t have to be registered to exist | It has to be registered to exist |

Assets | Can’t exist without assets | Can exist without assets |

Binding document | Trust deed | Foundation chart |

Challenges and Considerations

Banking Difficulties

Due to increasingly complex anti-money laundering regulations, some banks may be reluctant to open or manage accounts. Recently, we have seen major institutions moving away from this sector, thus making it harder for trusts to access banking services.

Compliance and Reporting Requirements

A trust is a legal structure, and as such, it must comply with reporting requirements, compliance, and even tax filing if it applies. Taking Nevis as an example, the country won’t tax foreign assets, but you will be responsible for declaring your trust assets in other jurisdictions. Americans must file annual reports to the IRS on their trusts and be compliant with FinCen requirements. The same applies to Canadians and other nationalities.

In some jurisdictions (Nevis is one of these), there are no specific filing requirements; however, it is mandatory to maintain records within the jurisdiction.

High Setup and Maintenance Costs

At Mundo, we offer three different packages (bronze, silver, and gold), constituting different layers of services. The more advanced the package, the more comprehensive the services. Consult your Mundo expert about the possibility of adding an LLC, accounting, or a bank account to the package.

Cook Islands Asset Protection Trust

Key Features of Cook Islands Trust

Like the Caribbean island, the Cook Islands doesn't recognize foreign court rulings. Furthermore, it has firm protection measures as all trustees are insured, and it allows the settlor to also be a beneficiary.

Advantages of Cook Islands Trust

Confidentiality and Privacy

If you're looking for confidentiality, this structure is ideal because the assets won't appear under your name on public records. This works to keep your information confidential from the public, for example, if you're an exposed person. Nevertheless, your information will be available to the authorities.

Fraudulent Transfer Laws

A creditor may use the Uniform Fraudulent Transfer Act to challenge the trust, stating that the transfer has been made specifically to avoid payment. With this, the opposite party may succeed in proving that the trust was established to commit fraud. This is why we recommend using this structure for its original purpose (which is asset protection) and not to avoid or circumvent responsibilities.

Challenges and Considerations

Enforcement Challenges

Another reason why a trust might be challenged is if there is no intention of separating assets from the owner. Any hint that might point to the settlor wanting to maintain control might create a reasonable cause to designate it as a sham trust.

This is why we don't recommend that the settlor and the trustee be the same person. The main point is to relinquish control so others can benefit, therefore, if the opposite party can prove that this is not the case, the trust can be intervened.

Comparative Analysis: Nevis vs. Cook Islands

Pros and Cons of Each Jurisdiction

Having established that both are outstanding for asset protection, there are some small differences to consider. As for protection, the Cook Islands never had a trust challenged, while Nevis stipulates a 100,000-bond requirement to even initiate a claim.

Which is Better for Asset Protection?

Unless you have high-risk assets or a complicated case, we recommend Nevis. With a more flexible structure and cost effectiveness, it is outstanding, while in terms of protection is almost just as strong as the Cook Islands.

Setting Up an Asset Protection Trust

Steps to Establish a Nevis or Cook Islands Trust

- Decide the purpose: the first step is to decide what the structure will do, for example, saving money for future generations, paying for kids' college when they're older, organizing inheritance after passing away, providing financial help for kids when they finish college, etcetera.

- Choose the assets: Now you will have to choose which assets will be transferred. This can be real estate, cash, jewelry, and so on.

- Choose a trustee: choose the trustee company or individual that will manage the assets.

- Choose the beneficiaries: point out exactly who will benefit.

- Draft and sign the trust deed: This is a document in which you will outline exactly how and when the assets will be distributed. The document must be signed before a public notary.

- Transfer the assets: when everything is set up, you proceed to transfer the assets. If this step is not done, then the trust will not exist, and the assets will be at risk. Failing to transfer the assets may be used in court as proof that the structure is fake.

Disclaimer: this article contains general information that can be inaccurate or outdated at the time of reading. Therefore, this article doesn't constitute legal advice. Before establishing a trust, consult with certified professionals.

FAQs about Asset Protection Trusts

Who Can Benefit from Asset Protection Trusts?

Any individual chosen by the settlor. They can be relatives or not.

What are the Costs Involved?

The settlor will have to pay government, registered agent, and address fees, plus legal services fees. Mundo offers three different packages, which include more comprehensive services as they escalate (incorporation of LLC, accounting, etc)

Disclaimer: The information in this article is subject to change. Accurate and updated information will be provided only through formal consultations.

Does setting up a trust exempt me from paying taxes?

No. If you set up a trust in Nevis, those assets won’t be taxable if located outside of Nevis, as the island has territorial taxation. Still, you will have to pay tax in your country/ies of tax residency and/or citizenship.

Conclusion and Final Thoughts

To sum up, both the Cook Islands and Nevis are excellent environments, with Nevis being the most cost-effective and flexible option. At Mundo, we have wide experience in setting up trusts in Nevis and can offer you any of our packages according to your needs and objectives.

Contact Us for More Information

Contact us if you are interested in any service related to asset protection or international business. We can set up companies, open bank accounts, help you buy real estate in Panama, or assist you in obtaining a second residency or citizenship. Write us a message with your enquiry, and let’s begin the process as soon as possible.

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

In the 21st century, the concepts of Nevis trust, asset protection, and wealth planning are almost s...

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...

In Panama, the real estate market is significant because of its convenient costs and the permanent r...

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's i...

Many embark on the journey that is going from Panama residency to citizenship, and this is quite an ...