If you have read the predictions of our expert team in the COVID-19 report you will see that any reasonable family office should start planning its escape from those jurisdictions that have shown an inability to deal with the crisis.

Sadly, much of Europe and the US fall under these categories. They will likely face increasing taxation, financial meltdown, and social unrest. You need a family office and these territories do not have many good options.

But Singapore is among the best.

Certainly, it is not for everyone, but a Singapore family office will guarantee your intergenerational wealth. Your child and grandchild will not have to worry about anything.

Why should you choose Singapore? In a nutshell:

1. Singapore does not tax worldwide income. Thus, no country will be able to claim taxes over your worldwide income while you live in a fully whitelisted jurisdiction. Plus, Singapore has a flat 17% corporate tax rate with plenty of tax incentives and a top 22% personal income tax rate, which is about half of the top income tax rate in most OECD countries.

2. Singapore has over 50 double taxation agreements. Therefore, tax optimization through a Singapore family office is one of the best structural vehicles in the world.

Singapore has one of the best tax residency regimes on the planet, and the best in Asia.

3. Singapore banks are highly liquid and property prices are rising. Plus, COVID-19 did not destroy the economy as in much of the western economies. Thus, you will invest your money in one of the strongest economies in the world.

4. Your family will have access to the highest living standards in Asia in one of the best education and healthcare systems in the world.

5. The integrity and proficiency of the financial and legal experts in Singapore are unmatched. This means you can just relax and enjoy the luxurious life Singapore has to offer.

Why do you need a family office?

You can read in detail what is a family office here. In short, a family office is a structure that handles the entire asset protection, investment, diversification, succession, tax optimization, and management strategy of a group of members.

These structures have protected families for centuries. It will allow you to avoid issues such as creditor and spousal claims, asset confiscation, inheritance disputes, bankruptcy, extorsion, among many other claims and issues wealthy people usually endure.

Thus, a family office or a group of family offices is the best way to diversify risk. Singapore is one of the best destinations you can choose. Its over 2000 millionaires (the most per capita in the world) prove it.

Building a family office in Singapore

Option 1: for those with capital up to 2 million

Very few experts know that Singapore has an existing and tailored financial and legal structure for attracting family office investors. It works in the following way:

STEP 1: If you are a family with 2 million in financial assets, you can invest in a government-approved, ultra-safe fund.

You can then appoint a professional team of consultants to run your family office.

STEP 2: The company can set up an immigration plan for the UBO and their family and place the income from the investment as permanent income of the UBO, meaning you can pay the balance into the family office.

STEP 3: The balance can be managed by the Family office. It can continue to invest in the thriving Singaporean economy, in instruments such as government-approved funds, real estate, shipping, and many other businesses.

Option 2: - for those with capital under $2 million

What if you have under $2 million in available capital? Then, you can create a company with a legitimate business goal in Singapore, which will serve as the base of your family office. It cannot be a passive investment but must bring genuine job positions and benefits to Singapore’s economy. Then, you can employ yourself in the company.

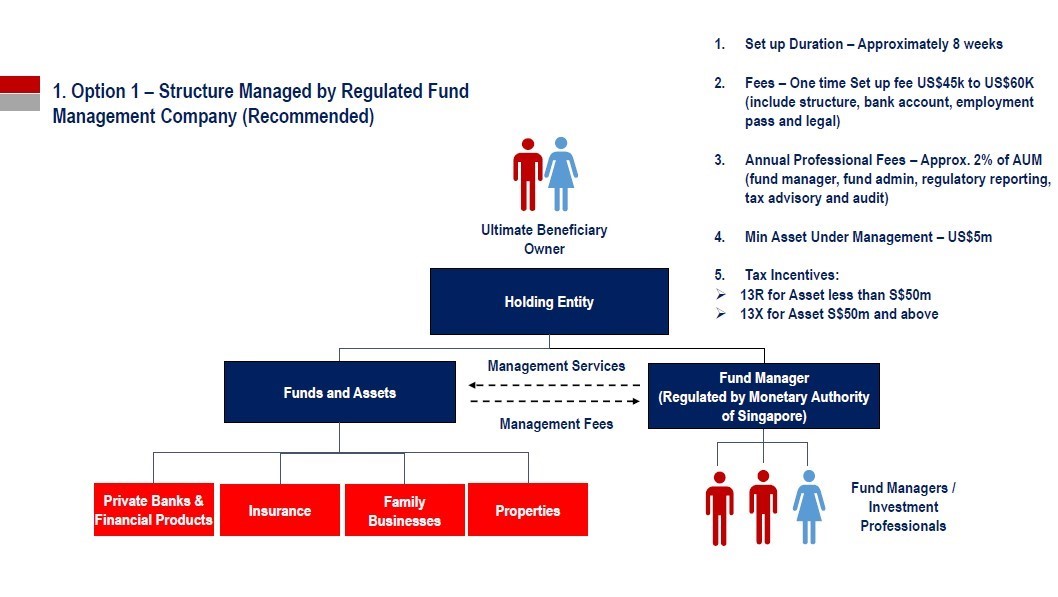

Option 3: - for families with over $5 million wealth

With families that want more control over their wealth, Singapore allows you to have a financial management company directed by Singapore professionals following your desired strategy.

Option 4: your own fund and fund manager - assets over $10 million

For families looking for the Lamborghini of Family Offices, Singapore allows you to set up your own fund with your own family office management company. Controlling your fund to invest in Singapore will give you more flexibility and diversification while you are insulated from other investment vehicles.

What can we do for you?

Mundo has teamed up with NTL, which has a joint office in Singapore with a family office team that has a fund expert, fund manager, corporate services and immigration expert, and concierge. Our office has provided a full family office set up and support to over 50 HNW Chinese families and is now opening our services to the US and Latin America via Mundo.

Through our partners, we offer a comprehensive package including:

- Immigration application for the family

- Family office corporate establishment and introduction to professional accountants, lawyers, or other experts you may need

- Fund manager

- Investment strategy management

- Concierge services, school, and property search

For a no-obligation consultation please contact us and enjoy the benefits of asset protection in Singapore.

$170,000

$1,400,000

$350,000

$395,000

$165,000

Решение о получении нового правового статуса редко принимается в одиночку. В большинстве случаев за ...

Современная банковская система все реже опирается на формальные признаки и все чаще анализирует сово...

Рынок жилья за рубежом всегда кажется сложным, пока вы не разложите его на понятные шаги. Панама при...

Когда человек начинает думать о сохранности имущества, разговор почти всегда выходит за рамки «где х...

Среднестатистический пенсионер при планировании жизни за рубежом всё чаще обращает внимание на предс...

Выбор другой страны в качестве правовой точки опоры почти всегда начинается с вопросов, на которые с...

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)