The Russian stock market

The Russian securities market is in the second place in terms of capitalization of world stock markets, which borders on the cost of Spain, Singapore, Saudi Arabia and Thailand.

Pretty much like Russia itself, the Russian stock market is full of contradictions. According to Alexei Afanasyevsky — founder of one of Russia’s securities markets— the peculiarity of the Russian stock market is that it is not a tool for regulating the economy or even influencing it; the Russian state has far simpler and effective tools for this.

On the one hand, this does not allow stock markets to develop, their capitalization remaining low. There is a clear underestimation, but the same factor protects stock markets from external influences and macroeconomic trends. For example, the macroeconomic statistics of Russia, such as consumption or employment, are almost not affected by the stock market. On the contrary, the conclusion or breakdown of trade negotiations between China and the USA affects the Russian market, as it creates an informational occasion for short-term speculative variations. But one cannot say that the stock market has degraded; it remains an effective tool for corporate borrowing and profitability.

Illustrating these contradictions, the Russian stock market is characterized by a low indicator of value relative to the country’s GDP - 40% and high profitability of the market itself. Since January 2017, all indices of the Russian market have tended to increase overall. In 2019, they reached historic highs and show 27% profitability ahead of the markets in Germany (26%), France (24%) and the United States (23%).

So, at the end of 2019, Russian stock markets took the first place in profit-making and in estimates of payback times for investments, which, coupled with a high dividend yield, means the Russian stock market has an important long-term growth potential from current values. The most highly profitable shares traded on the Russian stock market showed growth from 50 to 70% (shares of commodity companies). High returns of about 30%. were also shown by shares in the financial and IT areas. The dividend yield of most reliable shares of the Russian market functioning as both a share and bond are in the range of 8-10%, although there are quite reliable valuable assets with an income of 15%.

The largest subject of the Russian stock market is the Moscow Exchange, which, after merging with the Russian Commodity and Raw Materials Exchange, combined all stock and currency markets. A less important player is the St. Petersburg Exchange, but both exchanges provide a full range of exchange services for both bidders and stock issuers. Bidders in the Russian Federation can only be qualified organizations or persons licensed by the Central Bank of the Russian Federation, which issues licenses for brokerage activities, dealer activities, and for securities management activities. The Central Bank of the Russian Federation informs anyone who wants to get a license of the requirements for the qualifications of employees, as well as the requirements for the availability of own funds. These requirements vary by license type.

In conclusion, if you take the time to study (or request from us) the stock analytics for the last 5, then you will see that the Russian market is among the leaders in the global stock markets, in terms of relative risk and return on investment guidelines. This showcases, as mentioned earlier, Russia’s wishes for leadership, wealth and security.

Investments in Russian bonds

As you may have already guessed, Russian government loan bonds are not what they appear at first glance. Usually, people borrow only when they need money; but this is not the case for Russia.

First, we need to talk about bonds denominated in foreign currency. The Ministry of Finance of Russia began planning the first issue of long-term bonds of the state loan in 2010, when, after overcoming the financial crisis of 2008, the finances of the Russian state were in good shape. However, some fair reproaches were sent to the Ministry, asking why people should borrow currency at interest if being forced to use foreign exchange earnings in sovereign funds.

The minister shrugged off the skeptics explaining that Russia cannot exist in isolation for foreign investors, and that Russia needs a financial tool that will showcase confidence in the Russian economy. The placement of loans, he said, was supposed to take place in a safe size for the country’s financial system. And indeed, all external borrowing is far less than gold and foreign exchange reserves thus far.

In 2018 and 2019, the Ministry of Finance of Russia carried out only two issues of government bonds: an issue with a maturity of $ 1.5 billion in 2029 was placed by the Ministry of Finance of Russia at 4.375% yearly in March 2018, and an issue with a maturity of $ 3 billion in 2035 - in March 2019 at 5.1% yearly. Also, in March 2018, the Ministry of Finance extended the issue of Eurobonds maturing in 2025 by 750 million euros with a yield of 2.375% yearly. And in June 2019, it placed additional sovereign bonds in dollars with maturity in 2029 in the amount of $ 1.5 billion with a yield of 3.95% yearly and Eurobonds with maturity in 2035 in the amount of $ 1 billion with a yield of 4.3% yearly.

Regarding these facts, the American version of Forbes magazine quoted some very enthusiastic words by James Barrineau, the co-director of the emerging economics debt securities division of Schroders Investment in New York: “They became bulletproof. They can pay off all their external debts from the reserves of the Central Bank. In addition, they lower interest rates.

The currency is very stable. And they have the financial ability to spend money on their own economy.” Indeed, the release of these bonds at the height of the sanctions face-off had a curious effect; the shortage of Russian currency bonds led to the interest of foreign investors in other financial products of Russia and at the moment 29% of bonds denominated in the national Russian currency were purchased by non-residents of Russia, which was one of the reasons the Russian ruble ended up being strengthened.

However, the bonds of domestic loans of Russia are also not quite what they seem. For the Ministry of Finance and the Central Bank of Russia, they are not a necessity when it comes to restocking the budget. Instead, they act as a tool to regulate the money supply in order to reduce inflationary pressures, since a good coupon yield, as well as a supported bond deficit, allow market methods to remove excess funds from circulation.

OFZ (Russian acronym which stands for ‘Federal Loan Obligations,’ a coupon-bearing federal loan bond issued by the Russian government) types are now subdivided into bonds with a fixed or changeable coupon rate, short-term, medium-term or long-term, with a face-value or debt amortization. In 2015, bonds appeared with an indexed face value, the face value of the bond is revised monthly depending on inflation and the consumer price index, and a coupon yield of 2.5% is paid from the revised face value. In 2017, special OFZs were created for the general public — a type of bonds distributed through banks with state participation.

At the end of 2019, the average yield on federal loan bonds was set at 6%, while maintaining the positive dynamics of the national currency of Russia, these bonds can become a very attractive and reliable tool for foreign investors, even taking into account their purchase on the secondary market.

The federal loan bond market is a reference for coupon income for other types of bonds issued in Russia, among which you can find bonds of system-forming Russian banks with dominant government participation, state-affiliated commodity companies, infrastructure projects with hidden government guarantees. In this case, the coupon yield on bonds can get up to 8%.

The operator of the bond market denominated in rubles is the Moscow Exchange.

Investment projects on the Baltic Sea Coast

Real estate investment in Russia

The Russian real estate market has moved on from the days of earning big by taking big risks, embracing instead a more stable and profitable model. Under the previous market model, investment “bubbles” had inflated and burst twice, which affected the economy and overall social stability in a very painful way.

So, after all the problems that followed, the Russian state was forced to tighten control over the residential real estate market and get more involved in its planning. By handling state subsidies for mortgage loans, backing construction companies and increasing the number of housing markets, the Russian state manages to keep at bay explosive price increases, despite the constant decrease in mortgage rates. The state policy in this area is aimed at preventing housing from turning into a tool for speculative investment. This means that, although the modern housing market in Russia is relatively less profitable, it is stable.

According to the statistics, the income from residential real estate amounts to 2.5-3%. More profit can be made in this market by smartly investing in the construction of new buildings. Something similar is also taking place throughout other regions of Russia, in which house prices are spiking, but this is specific to the area. In the past year, the market has also seen an increase in demand for luxury housing.

Even though the Russian state practically does not interfere in other areas of the real estate market, the housing market makes them more stable; for instance, in commercial real estate, housing bubbles stopped growing, and the rise of business activity and the overcoming of sanctions have encouraged a healthy constant demand for office, retail and industrial premises. In this area, overtaking demand also accounts for luxury real estate and modern, high-quality retail premises of relatively small areas. Profits made from commercial real estate in Moscow and St. Petersburg are estimated to go from 5% to 10%, depending on the location and purpose of the property.

Throughout the regions of Russia, it might be worth keeping an eye out for the construction of commercial real estate in provincial cities, which fall into state programs seeking to update the urban landscape. Due to the fast growth of both foreign and domestic tourism, investment in the construction of hotel buildings in Russian regions seems pretty promising. This is especially true of St. Petersburg and the cities of the historical tourist route known as the “Golden Ring,” in which tourism is off-season. For example, in the city of Sergiev Posad, the main site for religious and historical tourism near Moscow, a deficit of 10,000 hotel rooms is being planned for the next 5 years.

[File:Url=/images/Deluxe Palace+contact.pdf;Title=Download brochure;]

Today, Mundo presents an exceptional investment opportunity in one of the most beautiful cities in the world.

The palace is located at the intersection of Bolshaya Morskaya and Gorokhovaya streets (Address: Bolshaya Morskaya 32), right in the heart of the Northern capital. Such famous landmarks of the Northern Venice as the Hermitage museum, St. Isaac's Cathedral, the Admiralty, the Church of the Savior on Spilled Blood, Kazan Cathedral and many others, can be reached in a few minutes from Bolshaya Morskaya 32. The building is intended to accommodate a boutique hotel, a restaurant, a prime office for international company, and a gourmet restaurant. The palace on Bolshaya Morskaya, 32 is a part of the architectural heritage of the former capital of the Russian Empire, part of its vibrant history.

The luxurious palace was built by architect V. Schröter., in the years 1887-1888. It was built to settle the "Russian for foreign trade bank". It was the first building specifically designed for bank purposes in St. Petersburg. The palace has an octahedral body with side arched driveways. There is a ballroom with a wide gallery, made at the level of the second floor. The hall overlaps the flat dome, thereby creating a semblance of an atrium.

The building is an architectural monument of federal significance, part of the UNESCO world heritage.

The mansion is located in the historical center of St. Petersburg, surrounded by the main highways of the city center, five minutes away from the subway station Admiralteyskaya. The building is located within walking distance from the stunning Nevsky Prospect and the famous ensemble of St. Isaac's Square. Here, in the immediate environment, the cultural and business life of the city is concentrated: government agencies, business centers, representative offices of large companies, hotels, restaurants, as well as many monuments of architectural and historical relevance.

Excellent location

5 minute-walk from the metro station «Admiralteyskaya».

10 minute-walk from the metro station «Nevsky prospect».

8 minutes by car to the Moscow train station.

24 minutes by car to Pulkovo airport.

Reconstruction process

1-2 floor transferred to the finishing due to the presence of security obligations.

3-4 floor transferred to the finishing dressing.

Possible internal redevelopment of premises for the project investor.

The building carried out a full cycle of repair and restoration work.

Preserved historical appearance of exteriors and interiors.

Currently, the following works are completed:

Restoration of a translucent multi-layer dome, including a colored stained-glass dome with an area of 120 m².

Restoration works with the elimination of accident rate of the entire building's body, including roofing.

Specification

2 571 м² total area of the building

15 parking places on the street and 5 parking places in the yard

Modern engineering: central ventilation system

Number of floors: 4 floors + basement with windows

Ceiling height: 2,8 – 4,3 m

Electric power: 249 kw

Options of the building

Representative offices for large companies, banks, medical centers

Boutique hotel with additional banquet functions

Advantages of this investment

Unique historical project of St. Petersburg

Location in the city center

Privately owned deluxe palace

Excellent transport accessibility

Own parking for 20 m / places (around the perimeter and in the courtyard of the building)

Modern engineering systems

The possibility of redevelopment of premises for the project investor.

Floors 1 and 2

1-2 Floor plans allow you to effectively organize the space and provide an opportunity to adapt the area depending on the individual transfer of the tenant.

1st floor area: 687 m2

Second floor area: 727 m 2

Ceiling height: 3,5 - 4, 4 m

Floor 2

Representative and restaurant

Target audience: business meetings, conferences, banquets, buffets

Floor area: 727 m 2

Ceiling height: 3,5 -4,3 m

Floors 3-4

Cabinets or hotel rooms

Target audience: owners and top management of Russian and international companies

Floor area: 383+178 m 2

Ceiling height: 3,5 m

Commercial terms

Basic conditions of cooperation:

Sale of a building with a land plot

Long-term lease agreement

Performance at the expense of the lessor:

facade restoration

restoration of the rotunda and roof

engineering infrastructure

fulfillment of KGIOP regulations

preparation for finishing

Customer /tenant

final finishing and equipment

About the developer and Mundo

The developer in charge of Deluxe Palace is one of the most prestigious developers in Russia. This group of companies has been successfully operating in the construction market of St. Petersburg since 1997. The main activities of the company are development of residential and commercial facilities and construction and building renovation.

By investing with this developer through Mundo you will have special benefits and advantages that are exclusive to our readers:

We speak Russian. We have a talented team of realtors and agents who speak Russian, English, and Spanish. This means that through us you will break through the language barriers and be able to access a great investment opportunity that you wouldn´t be able to access otherwise.

Special offers. We have a special relationship with all of our partners and developers, some of these relationships are based on a long-term friendship. For this reason, we can offer special discounts, opportunities, financing options, etc.

We treat you like family. Since we have a team in Russia, we can help you and walk you through the country´s culture when visiting Russia.

Co investment opportunities. Since we have a wide network of experts, agents, and developers in different parts of the world we offer exceptional opportunities for co investment and B2B – B2C opportunities.

If you want to invest in the historical center of the most beautiful city in the world, please contact us and ask for a consultation.

[File:Url=/images/Deluxe Palace+contact.pdf;Title=Download brochure;]

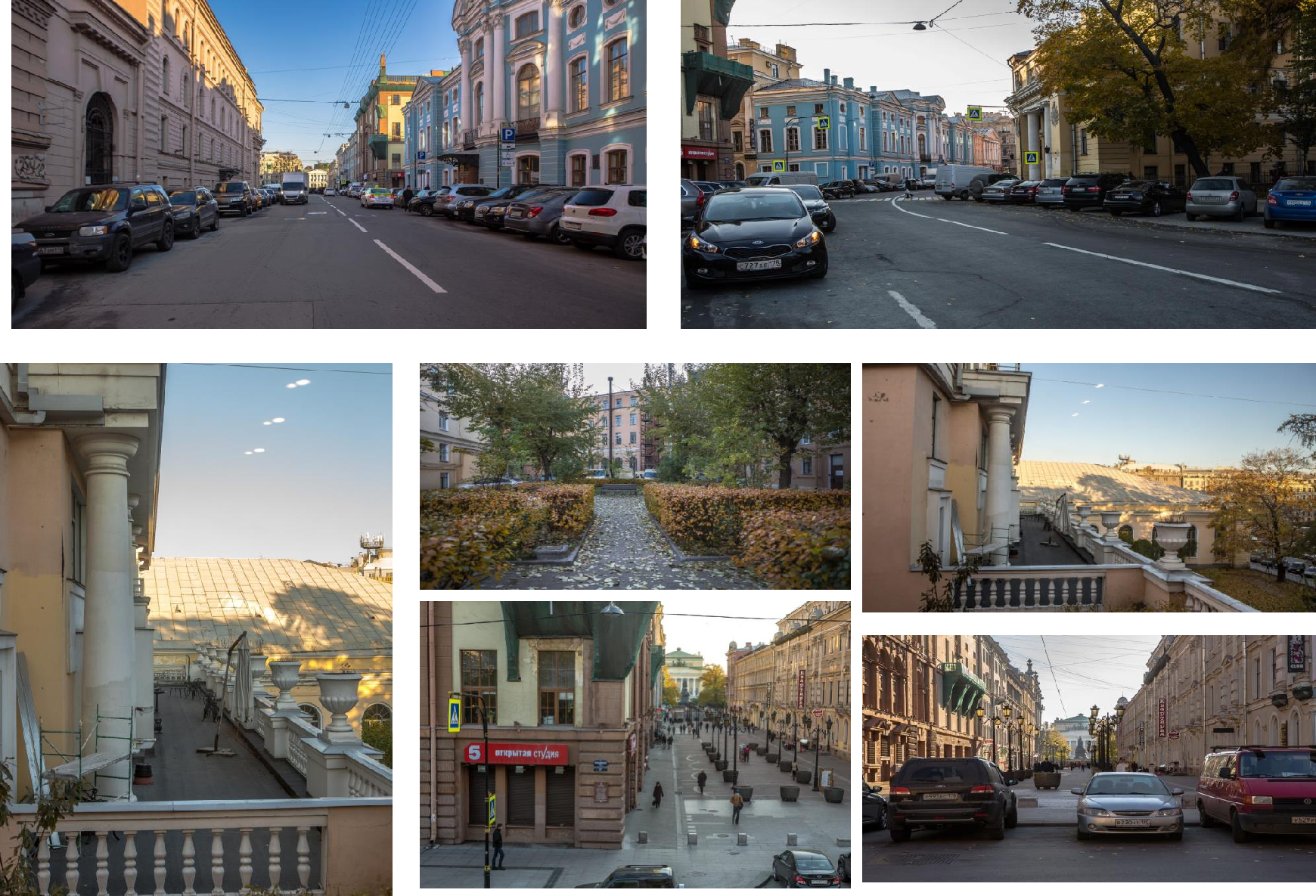

This project is a three-flor building with an area of 908 sq meter, with a basement and an attic that can be reconstructed to add another floor.

The building is equipped with all utilities and communications and is possible to make an elevator.

It is a classic building constructed in 1860, which received a major overhaul and reconstruction in 2001.

The building has been historically residential, but its location makes it ideal for hotel accommodation, especially with small departments for long-term stays.

[File:Url=/images/Nevsky Prospect 32-34H.pdf;Title=Download brochure;]

This project is a unique opportunity located in St. Petersburg historical center. It’s a 5-floor, 7,000 sq meter house that is intended to be rebuilt as a 5-star hotel, increasing the total construction area up to 12,930 sq meter to create 172 rooms.

The only part of the house that is a monument of history and architecture is the Rossi Portico.

According to the most pessimistic estimates, the project’s yearly revenue will be almost $11 million with an average occupancy rate of 50% at $350 per room per day. The market value of the project after completion will be of at least $137 million.

This project is located in Leningradskaya oblast, near Saint Petersburg, Russia’s second-largest financial center.

lll.jpg)

Modern business center on the river embankment in the heart of Saint-Petersburg.

Area of 2 558 м², basement + 3 floors + mansard

The mansion of the Palma Society of German Craftsmen was built in 1886 by the architect Ivan Aristarkhov.

Here the modern culture is synthesized with the spirit of the 19th century. Today the mansion, which once belonged to the society of German artisans, is adapted for comfortable work and creativity. The theater hall is suitable for festivals, concerts and exhibitions. There is a coffee shop on the roof with a panoramic view of the historical part of St. Petersburg.

The luxurious theater hall with an area of 250 m2 has a unique interior. The adaptability of the space allows it to be used for various formats of events: film screenings, festivals, markets and fairs, weddings, dinner parties and corporate events.

$170,000

$1,400,000

$350,000

$395,000

$185,000

Интерес к формату CBI растёт, особенно среди тех, кто рассматривает международную диверсификацию ста...

Когда речь заходит о программе квалифицированного инвестора, чаще всего обсуждается недвижимость. Им...

Решение сменить страну проживания всегда связано с вопросами уверенности и предсказуемости. Человек ...

Панама давно привлекает внимание людей, которые рассматривают переезд, инвестиции или покупку жилья ...

Международные инвесторы рассматривают недвижимость как инструмент сохранения капитала и формирования...

В последние годы Панама стала одним из самых привлекательных направлений для международных инвесторо...

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)